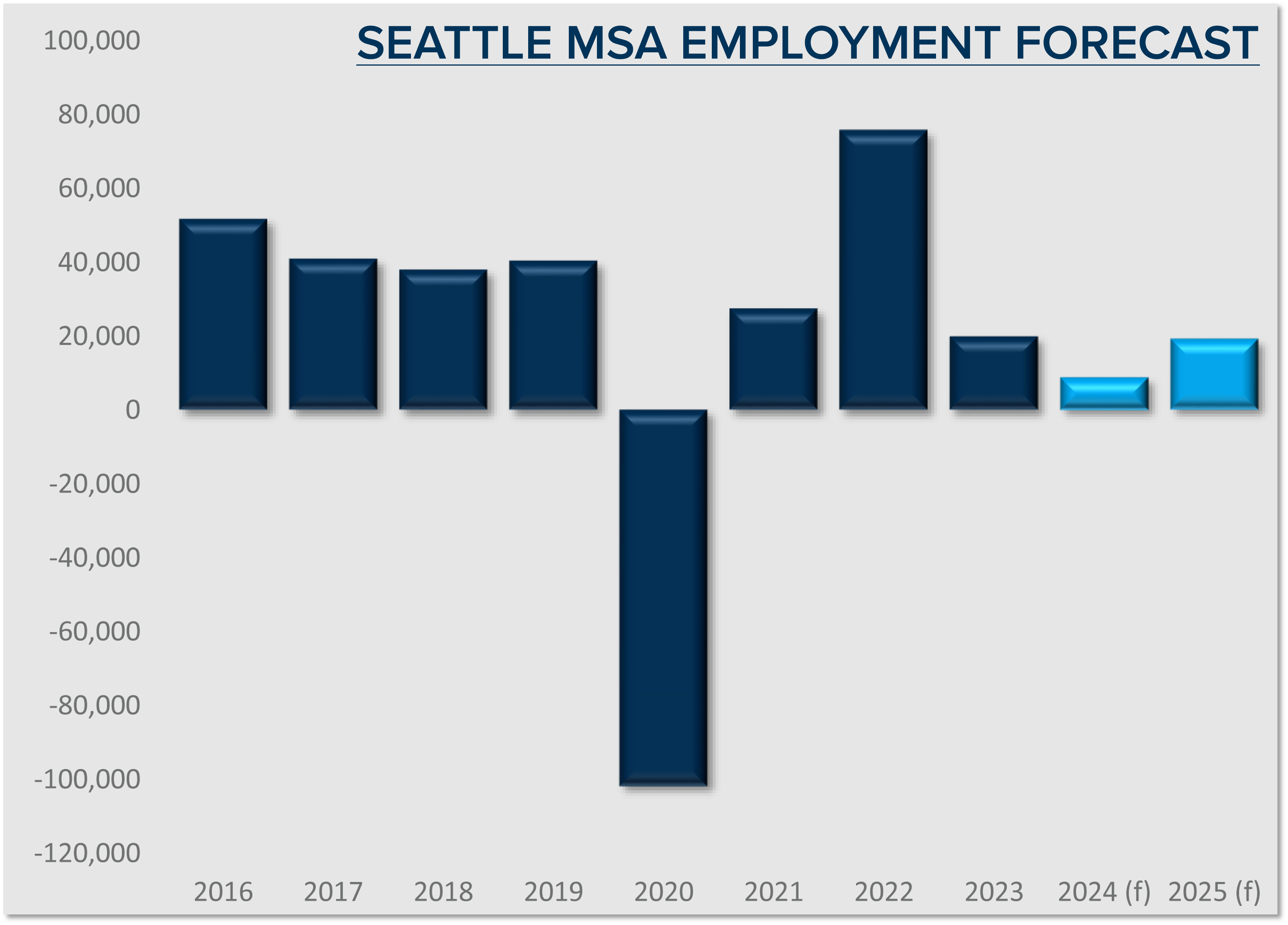

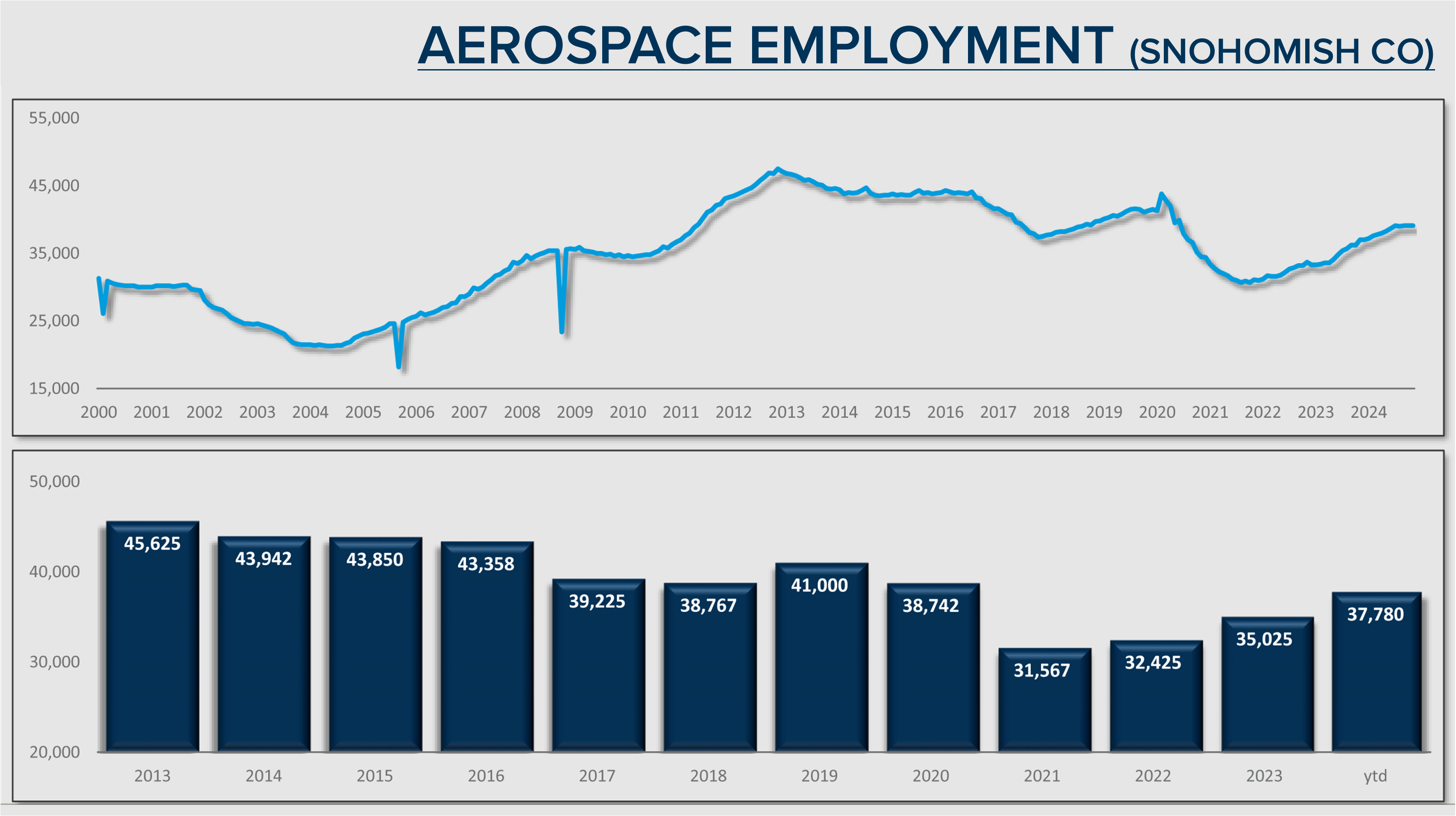

As we start a new year, I am often asked where home prices are headed. While I don’t have a crystal ball, I study the market trends and activity closely. Many aspects affect home prices, such as the overall economy’s health, inventory levels (supply & demand), and interest rates. Seasonality is also a pattern I pay close attention to, and we are headed into the time of year when we see most of the annual price growth happen. As we prepare for the Spring market, I have pulled some data that shows the seasonal patterns and the impact interest rates have had on prices, and long-term equity growth.

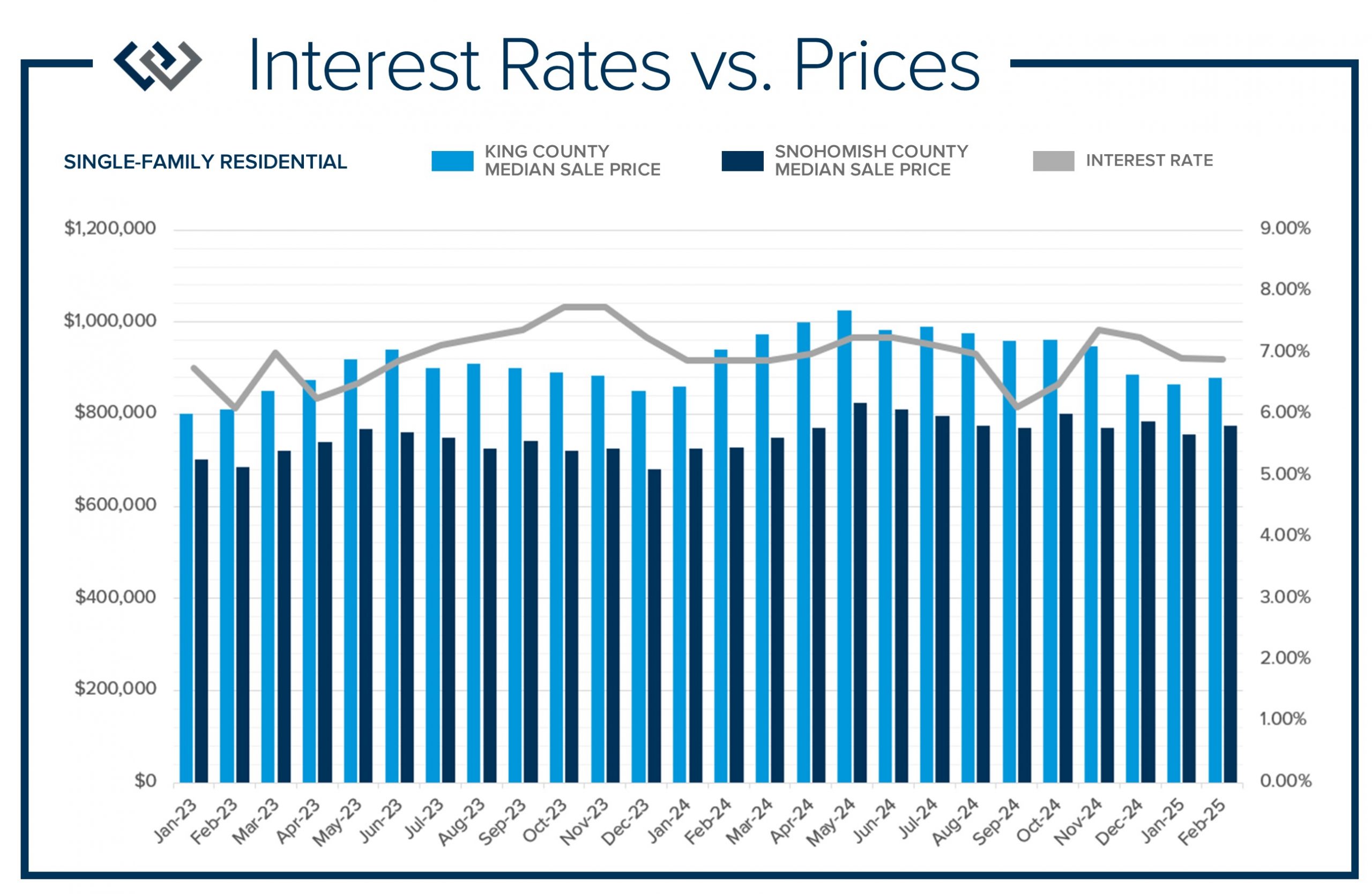

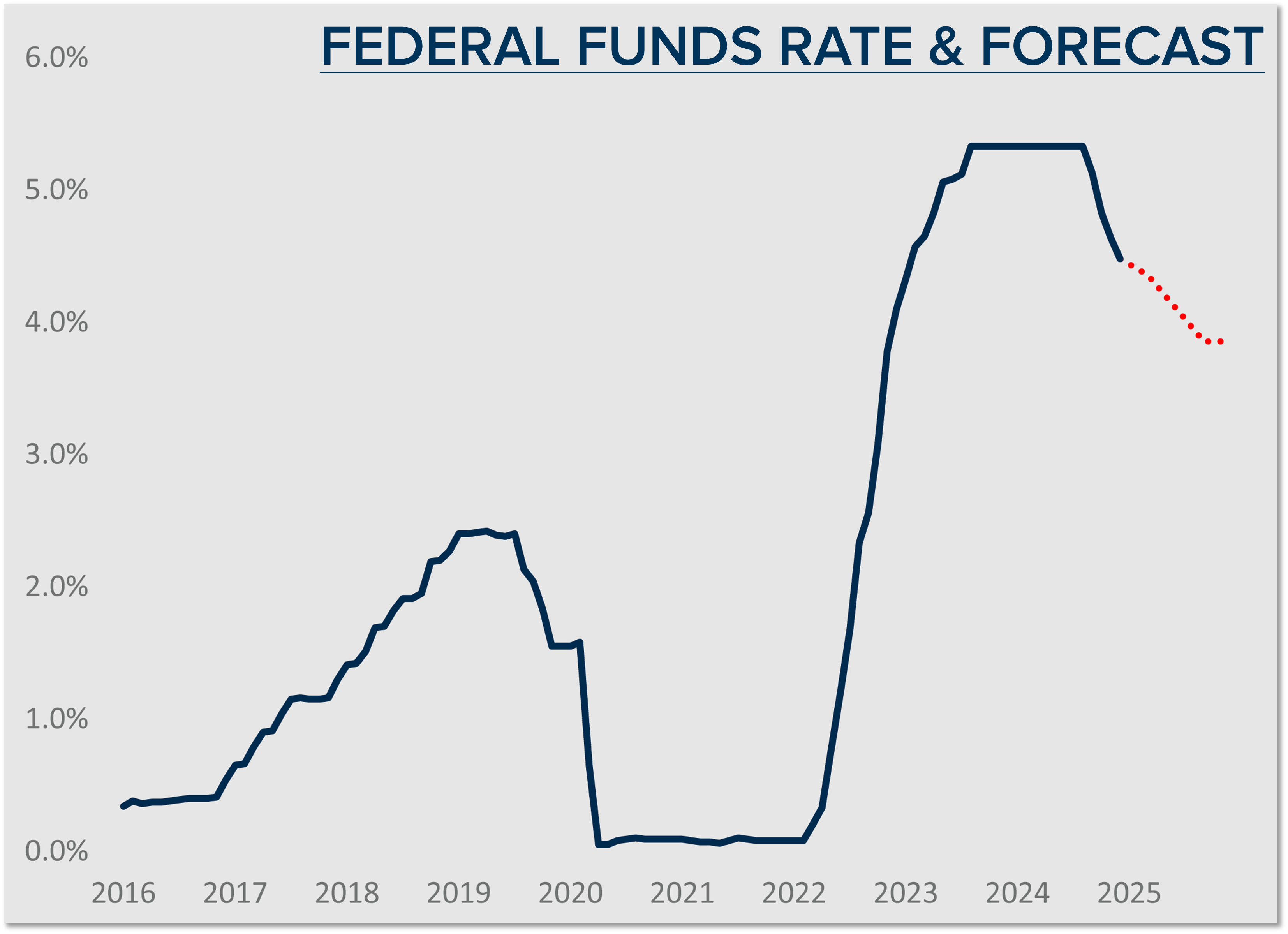

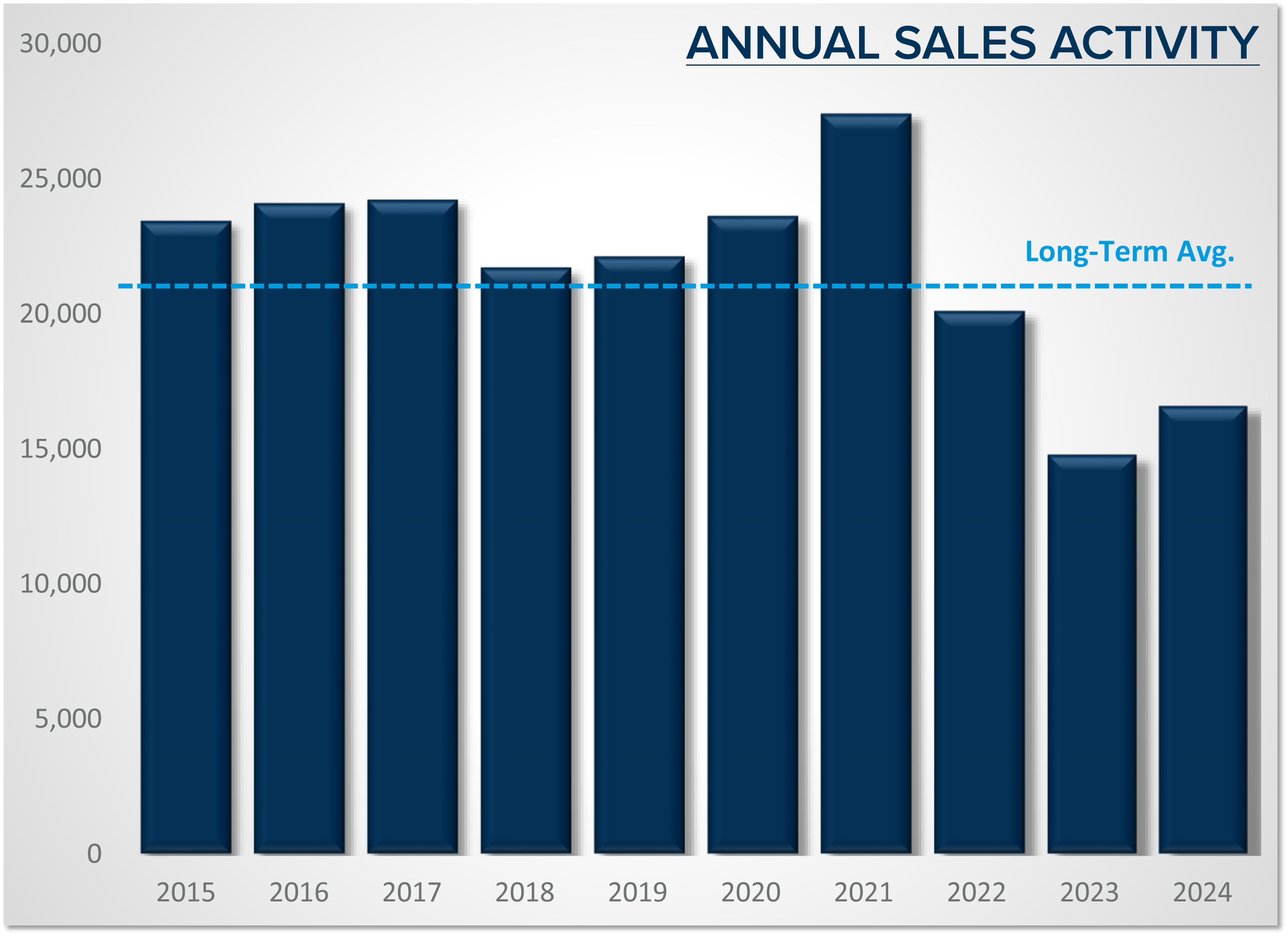

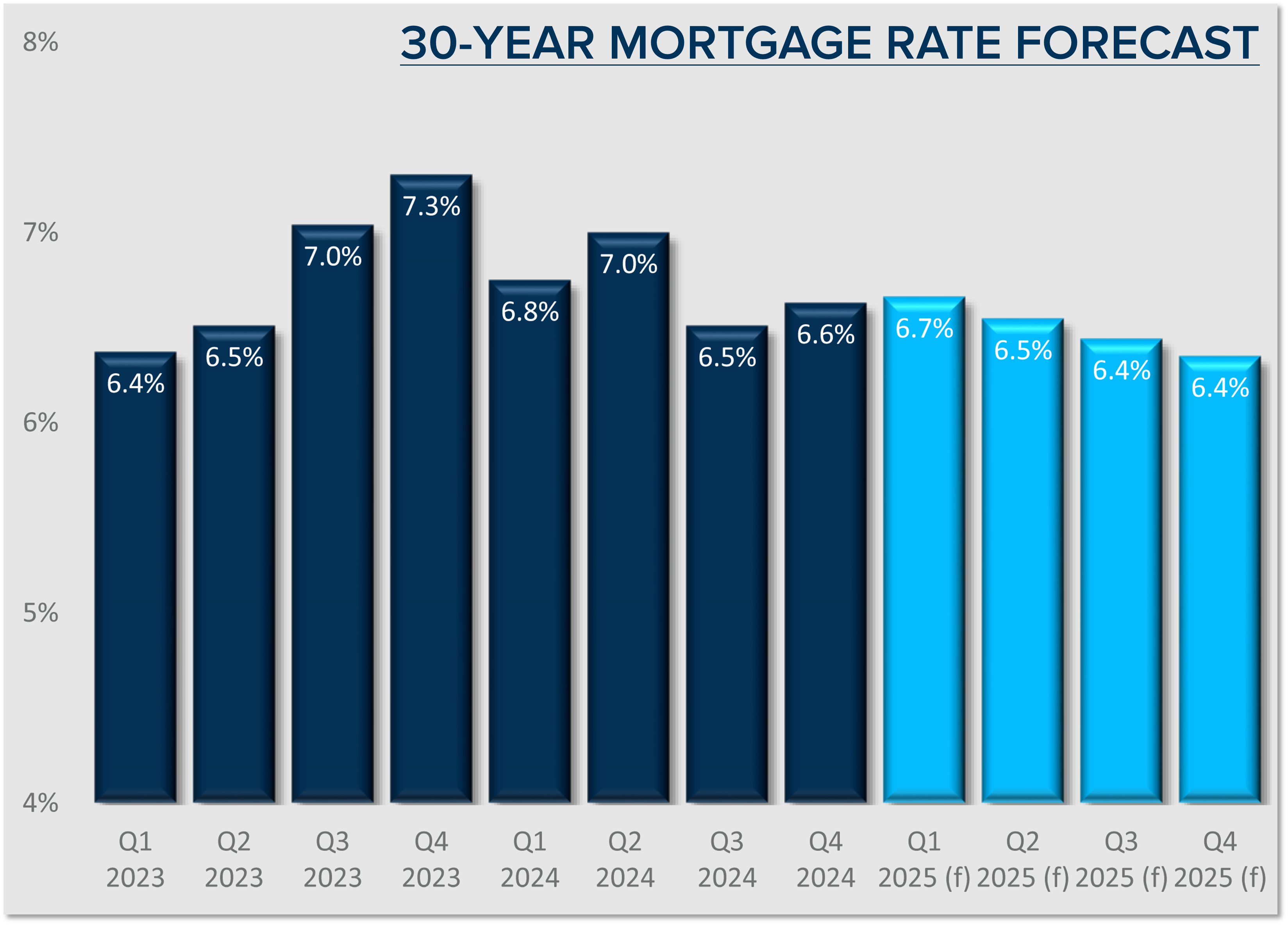

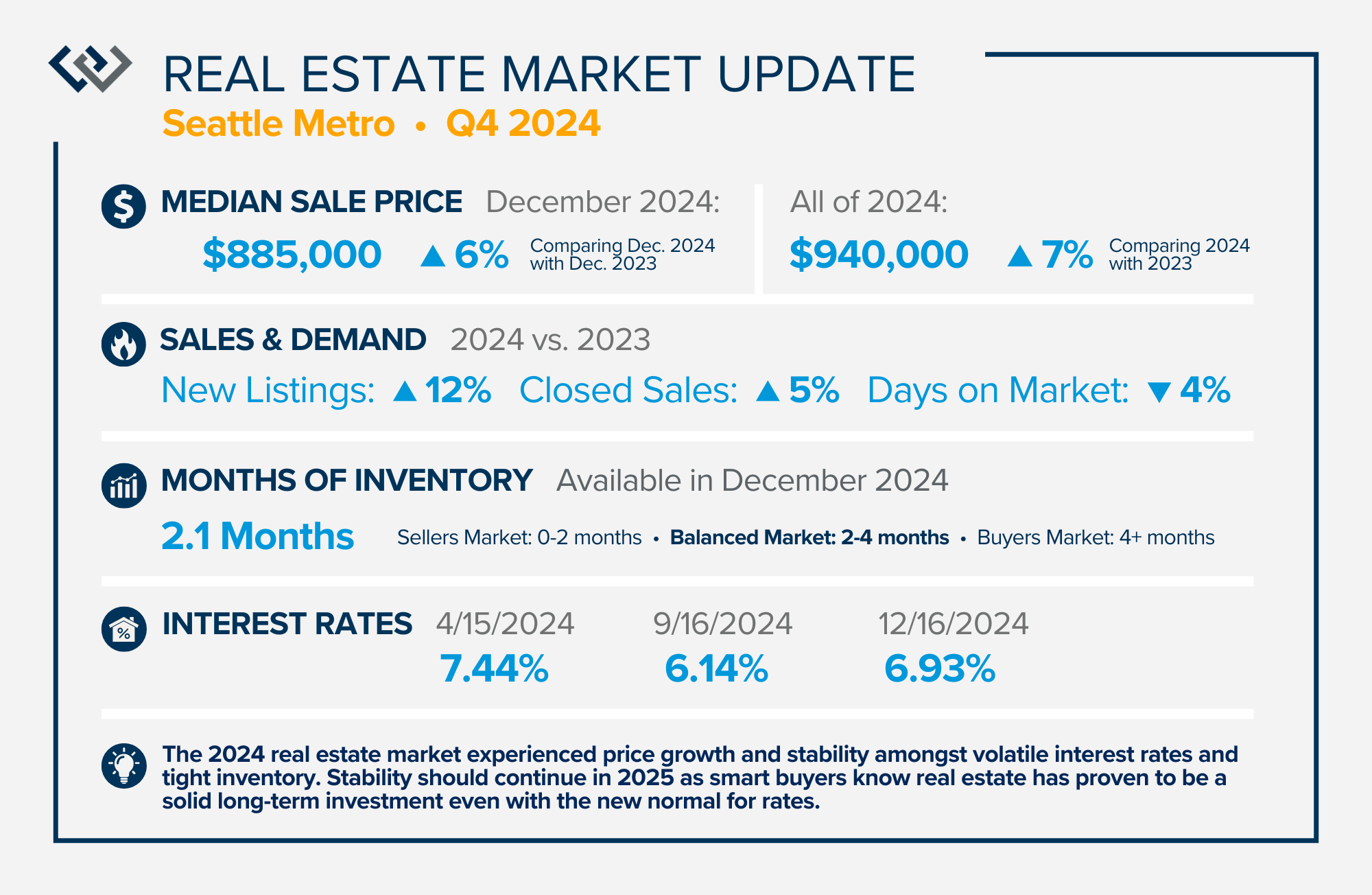

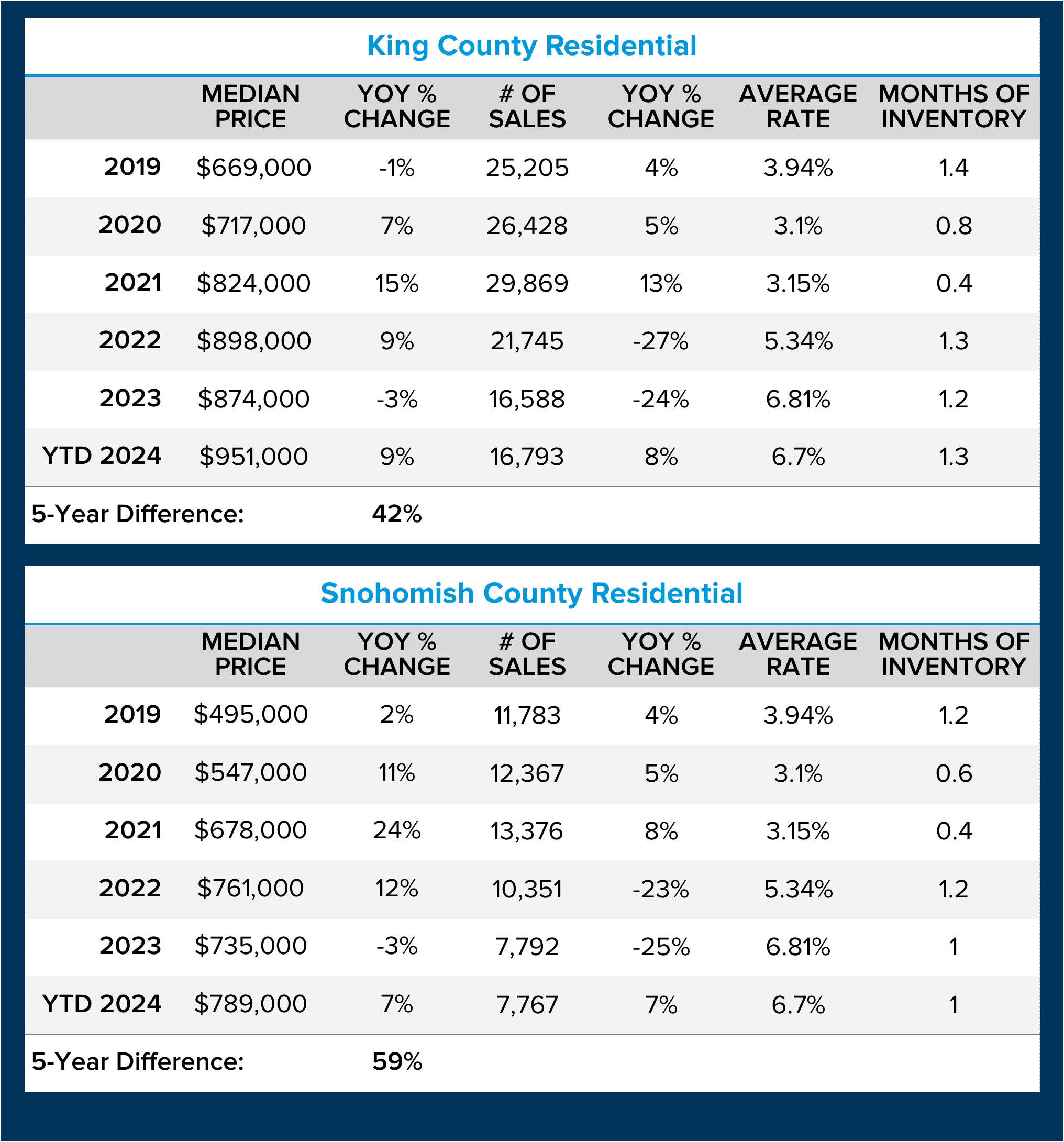

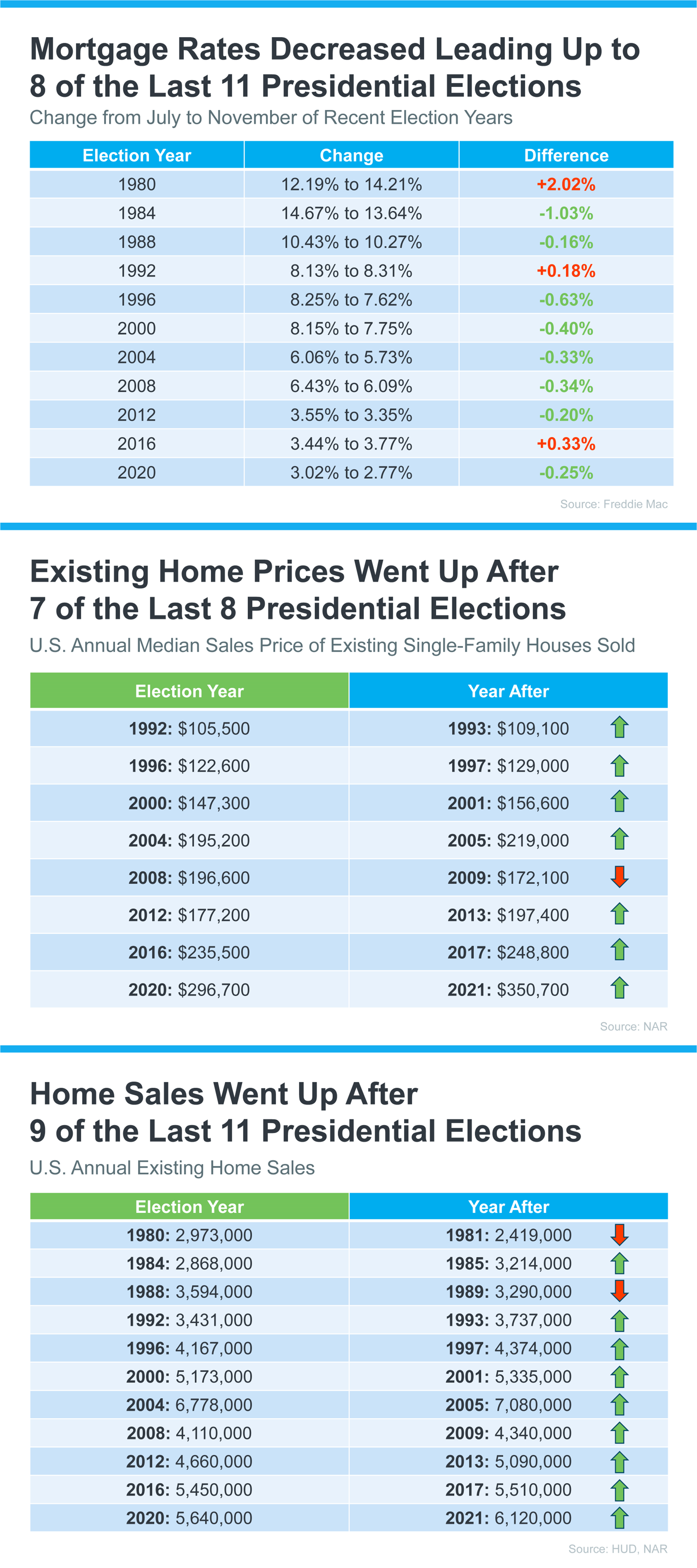

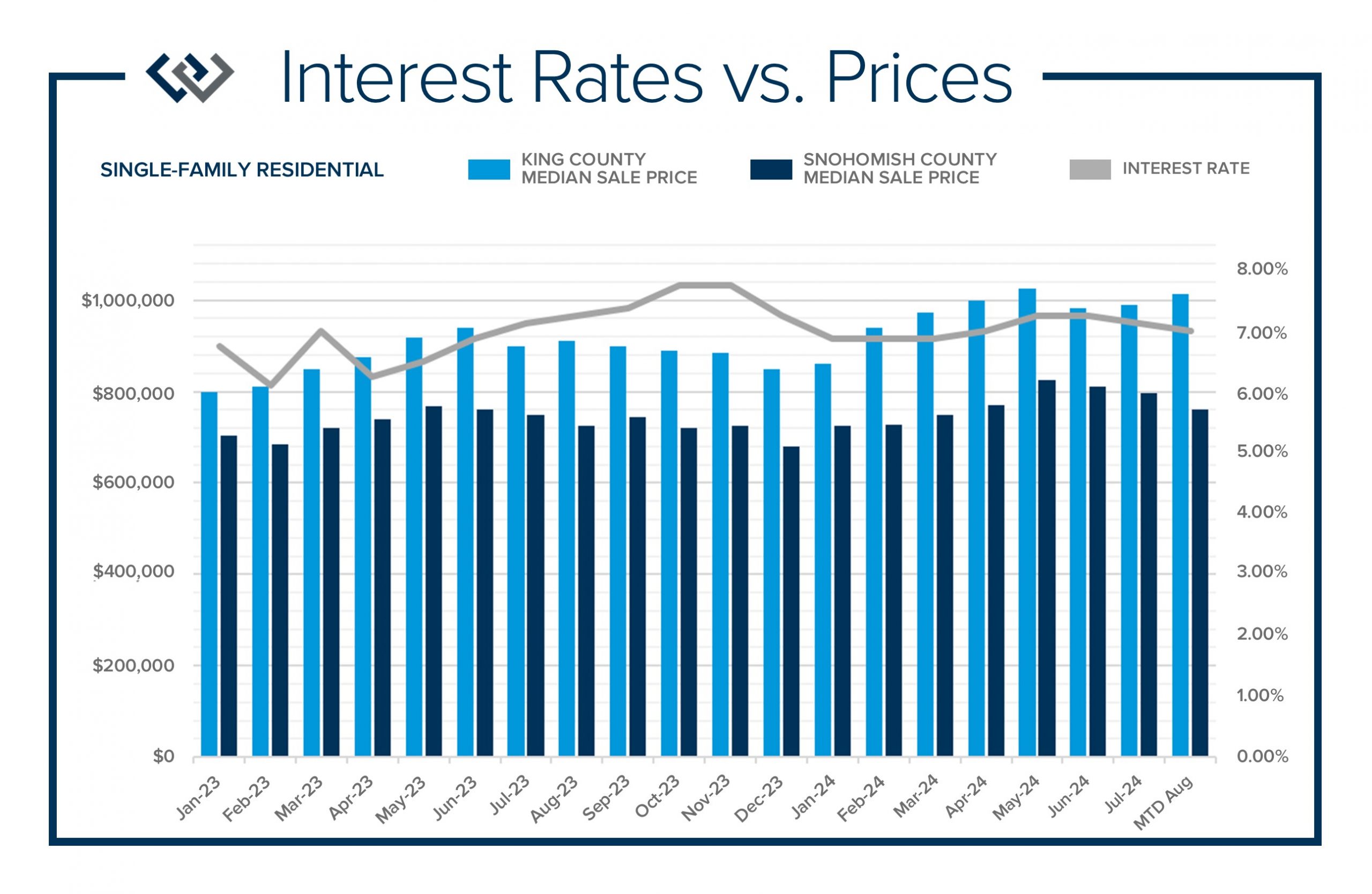

First, before we look forward, we must look back to understand the relationship between rates and prices. We went on a long run of rates being below 5% from 2010 to mid-2022, outside of the second half of 2018. Price growth was consistent after the recovery from the Great Recession in 2012 to 2018 and, in some cases, incredibly rapid. When the increase in interest rates happened in 2018, along with the proposed Seattle Head Tax, we saw a correction in home prices. It took the market about 15 months to recover from that correction.

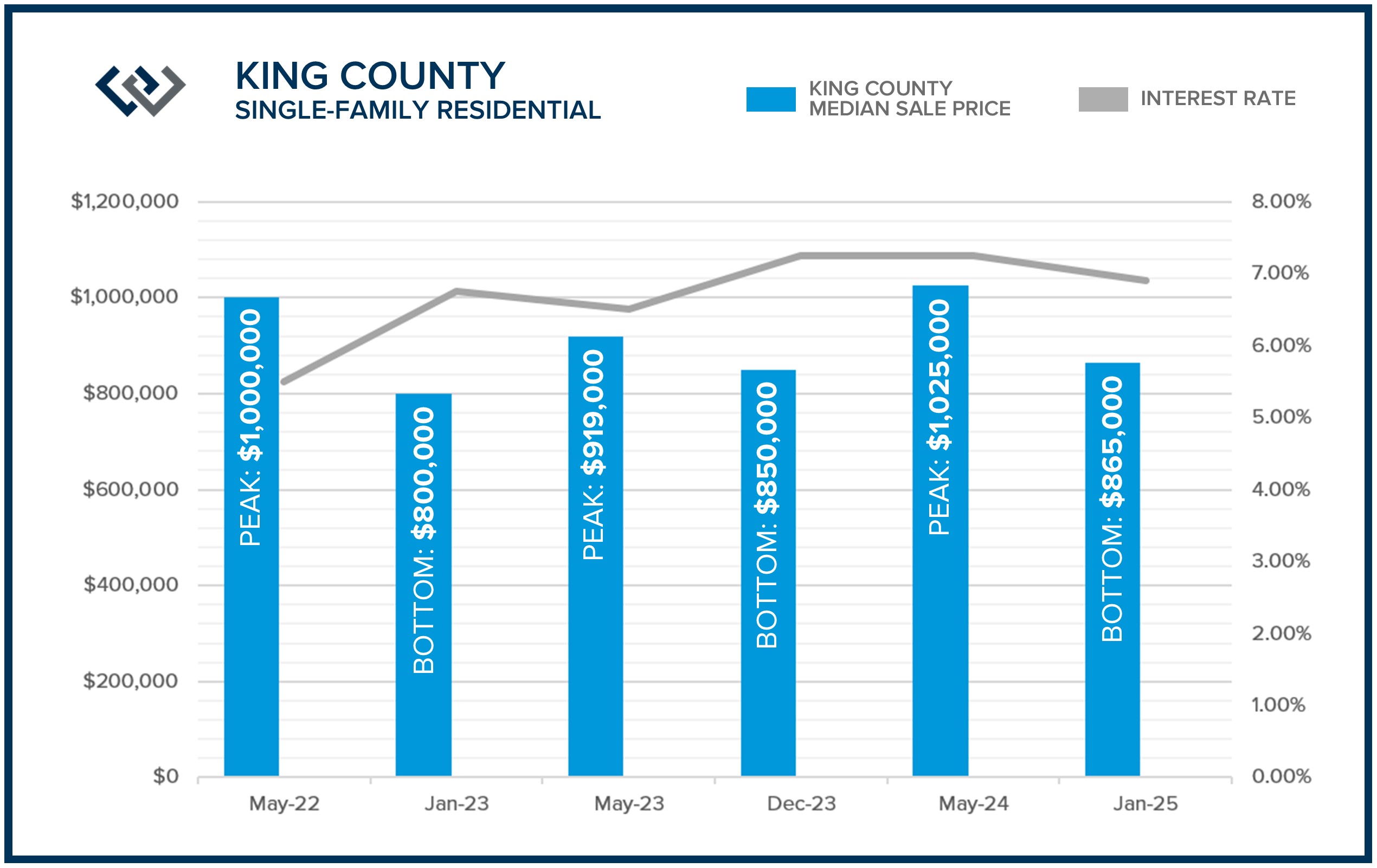

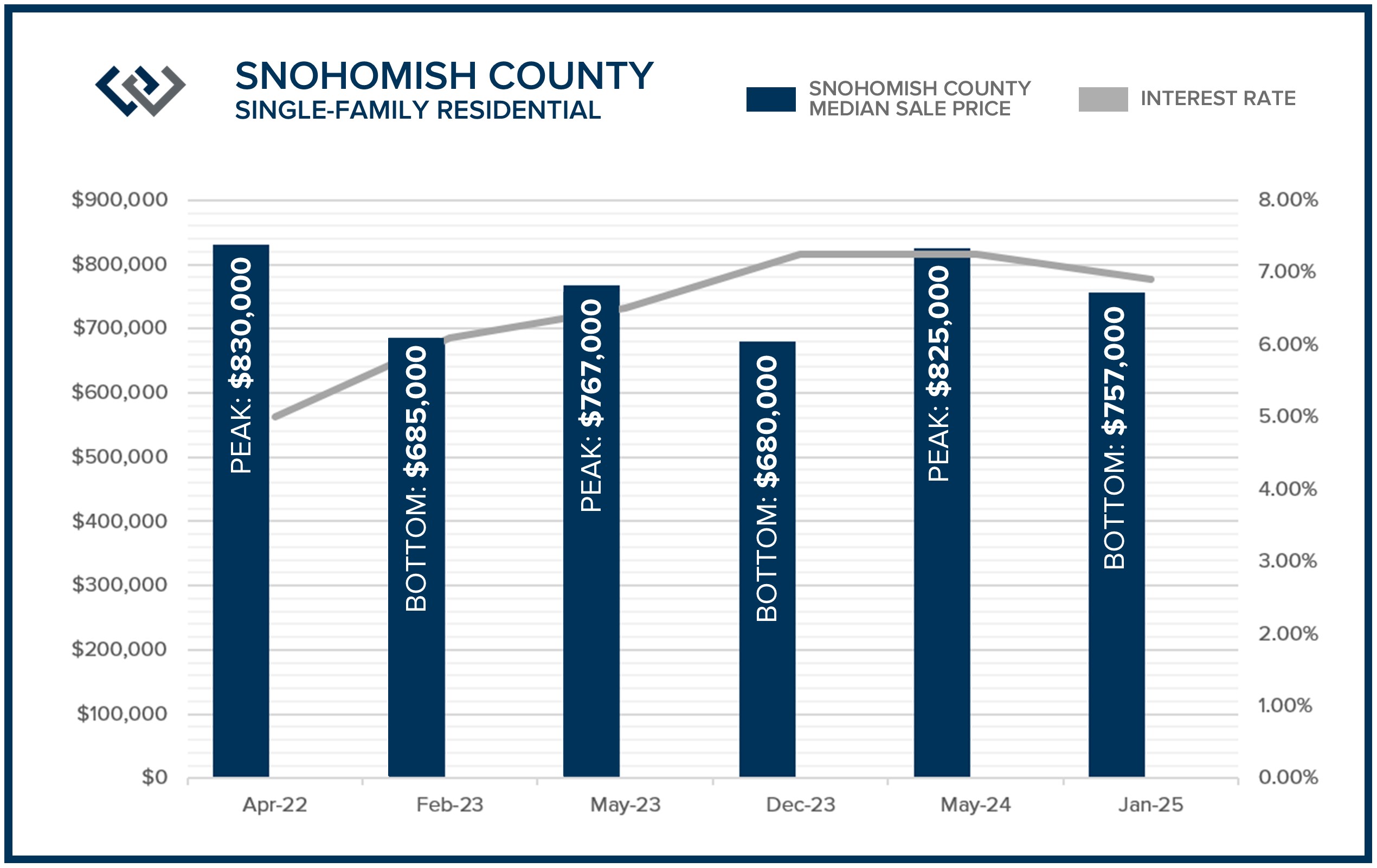

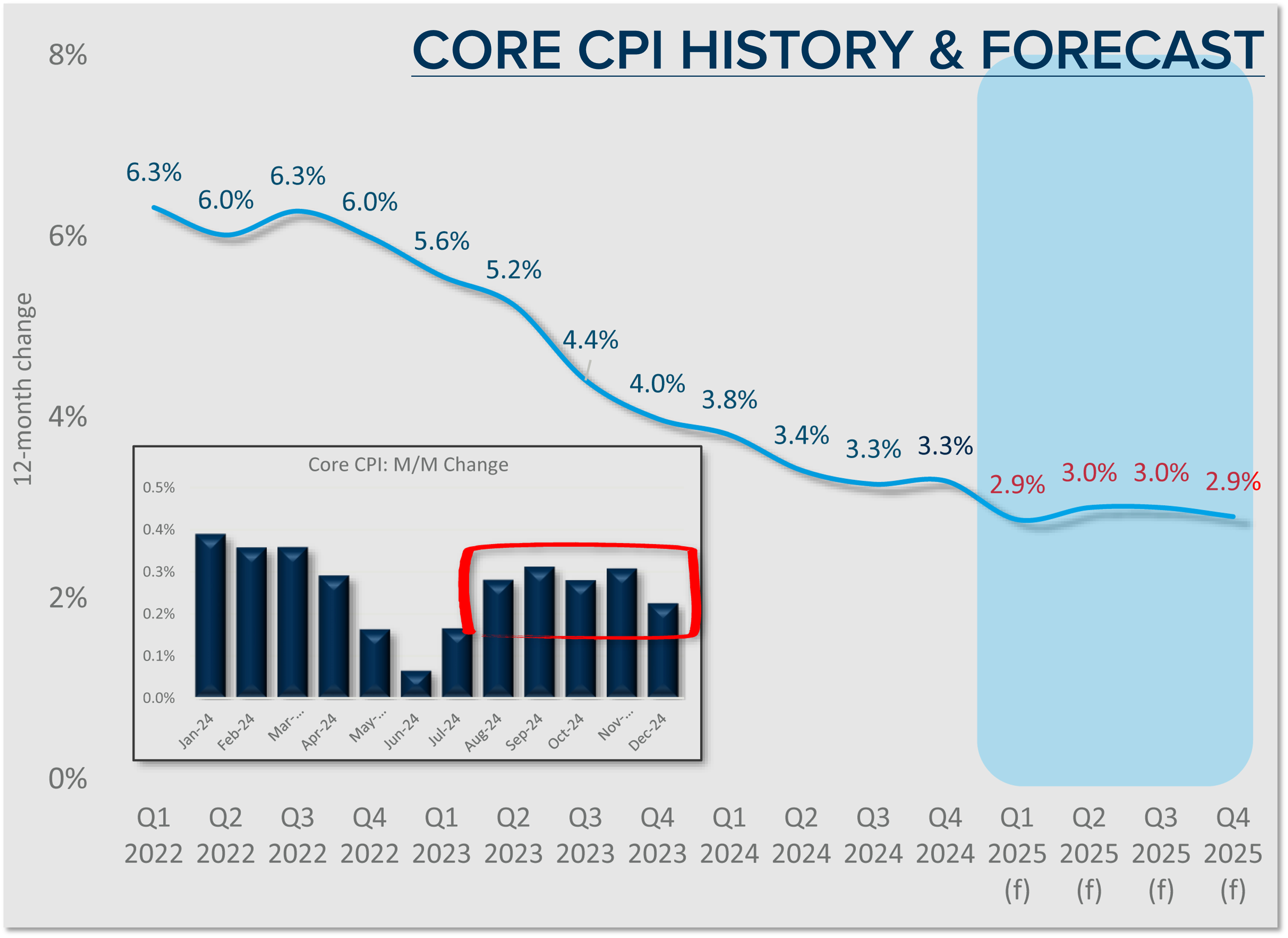

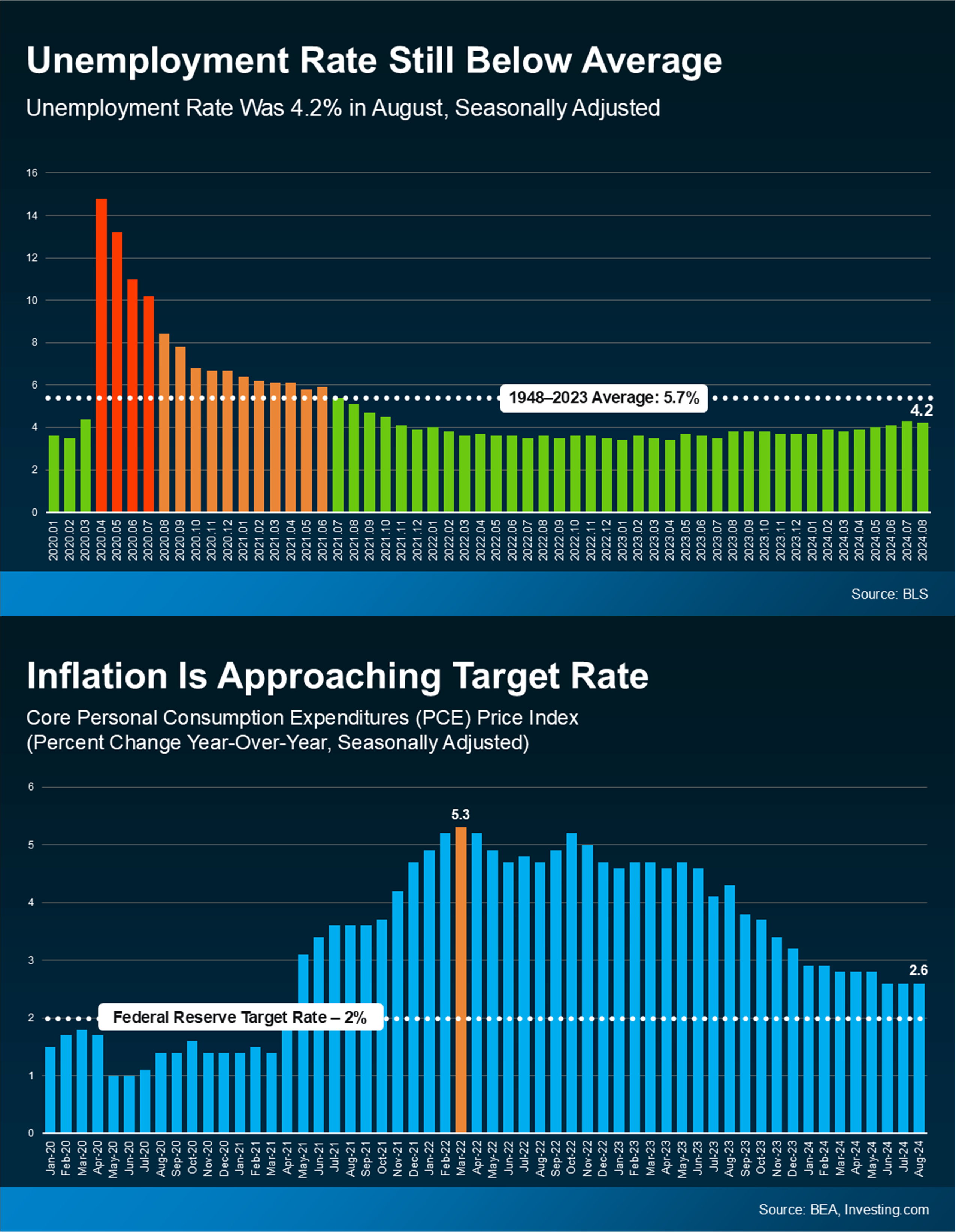

Then, we hit the pandemic-fueled market of 2020-2022, where price growth was off the charts. During that time, work-from-home moves flooded the suburbs and rural markets, early retirements and relocations to other states created movement, and interest rates under 3% drove prices up by double digits. At the beginning of 2022, rates started to creep up to counter inflation and increased by 2 points in four months, landing at 5.5% in May 2022. This, like 2018, forced a correction in prices. This correction took 24 months to recover, with prices regaining their May 2022 peak in May 2024.

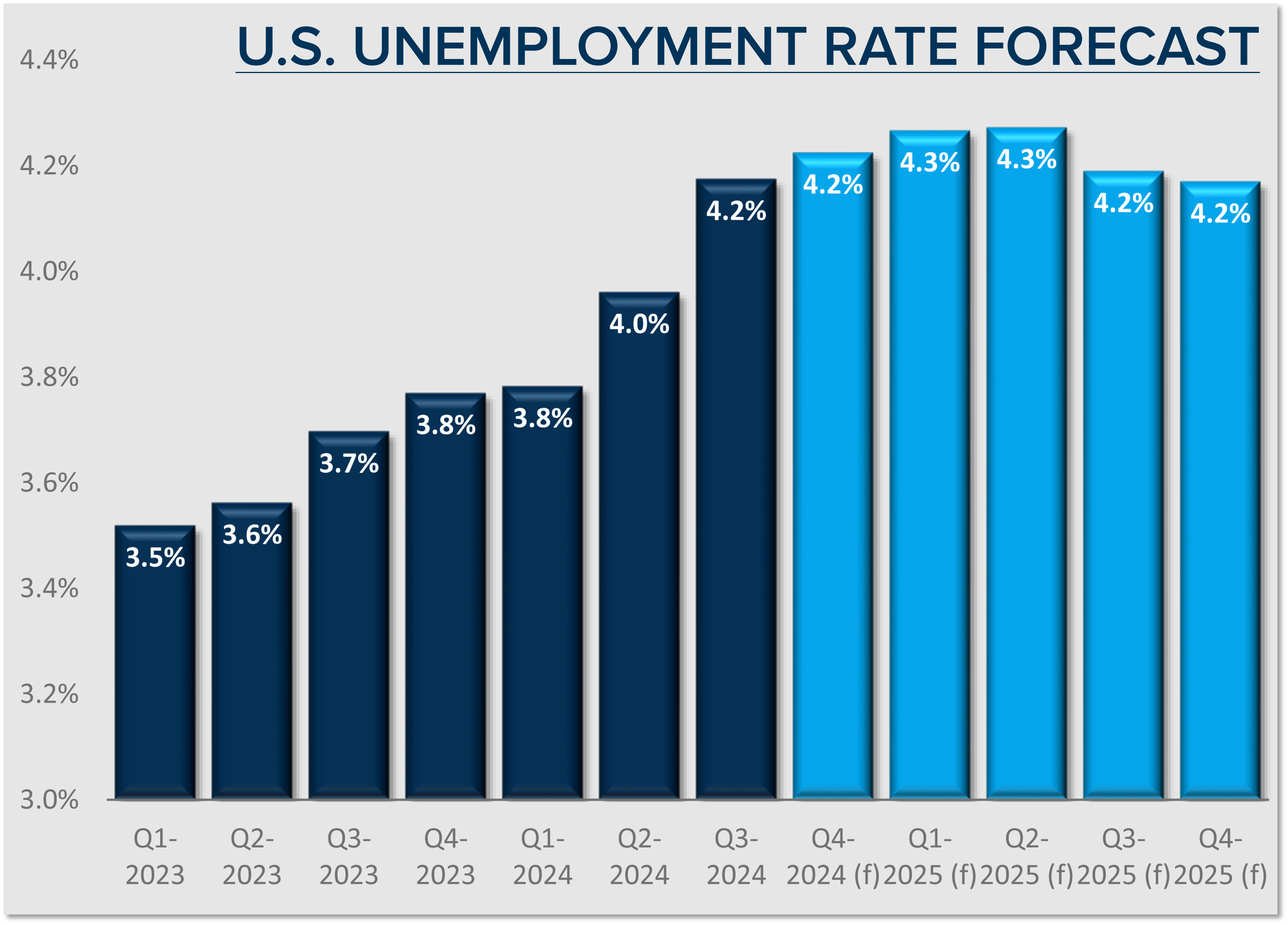

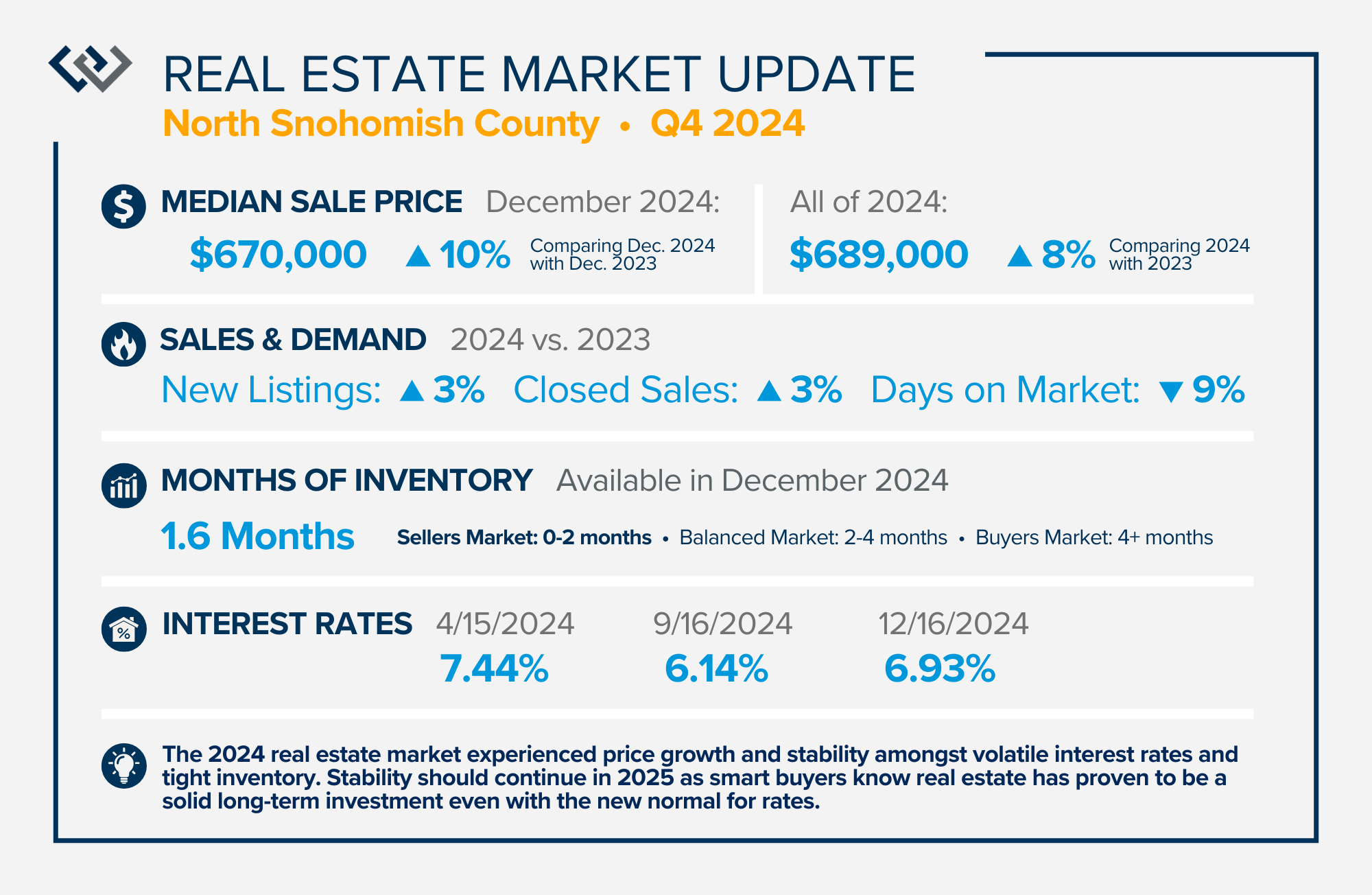

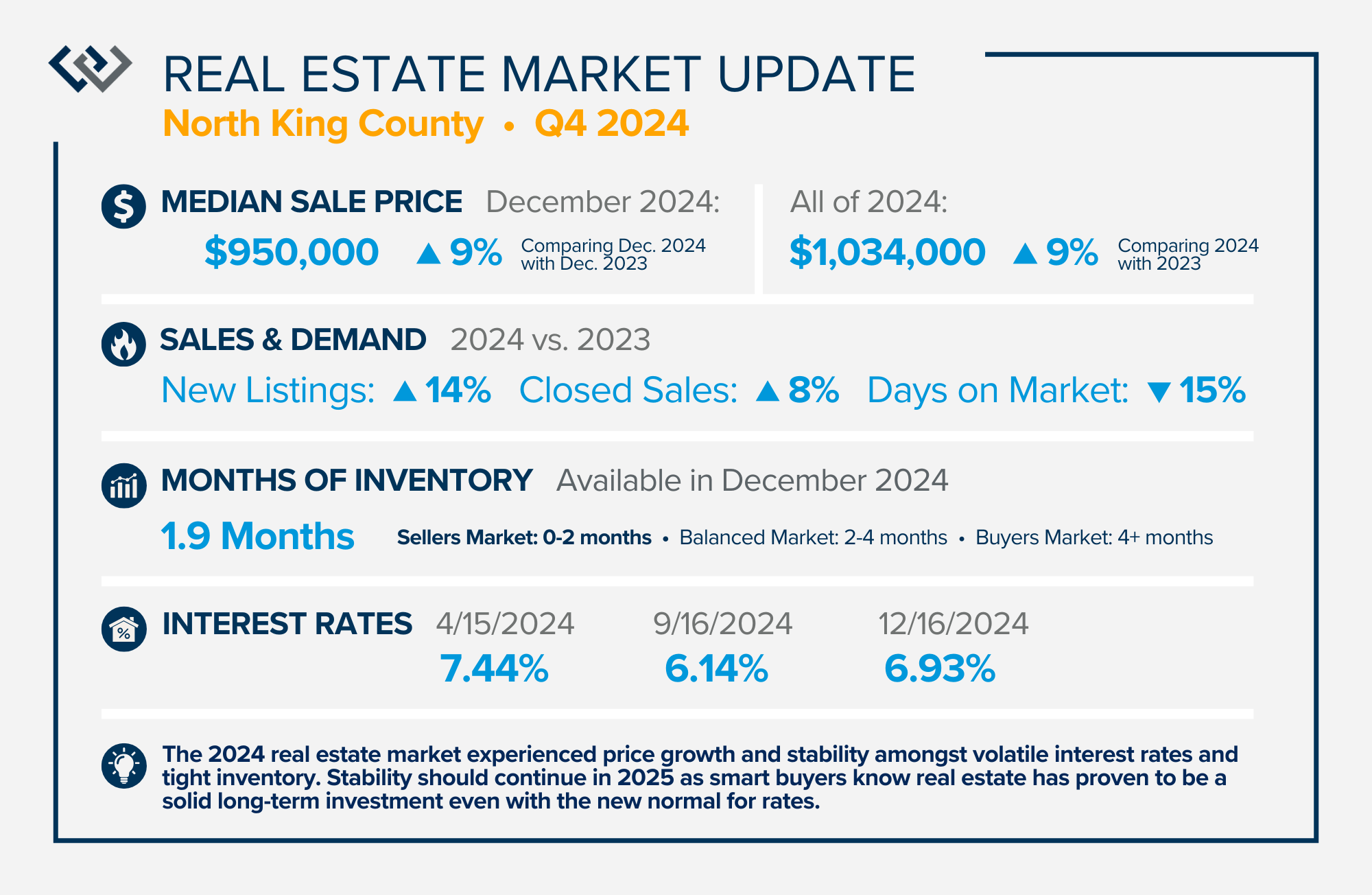

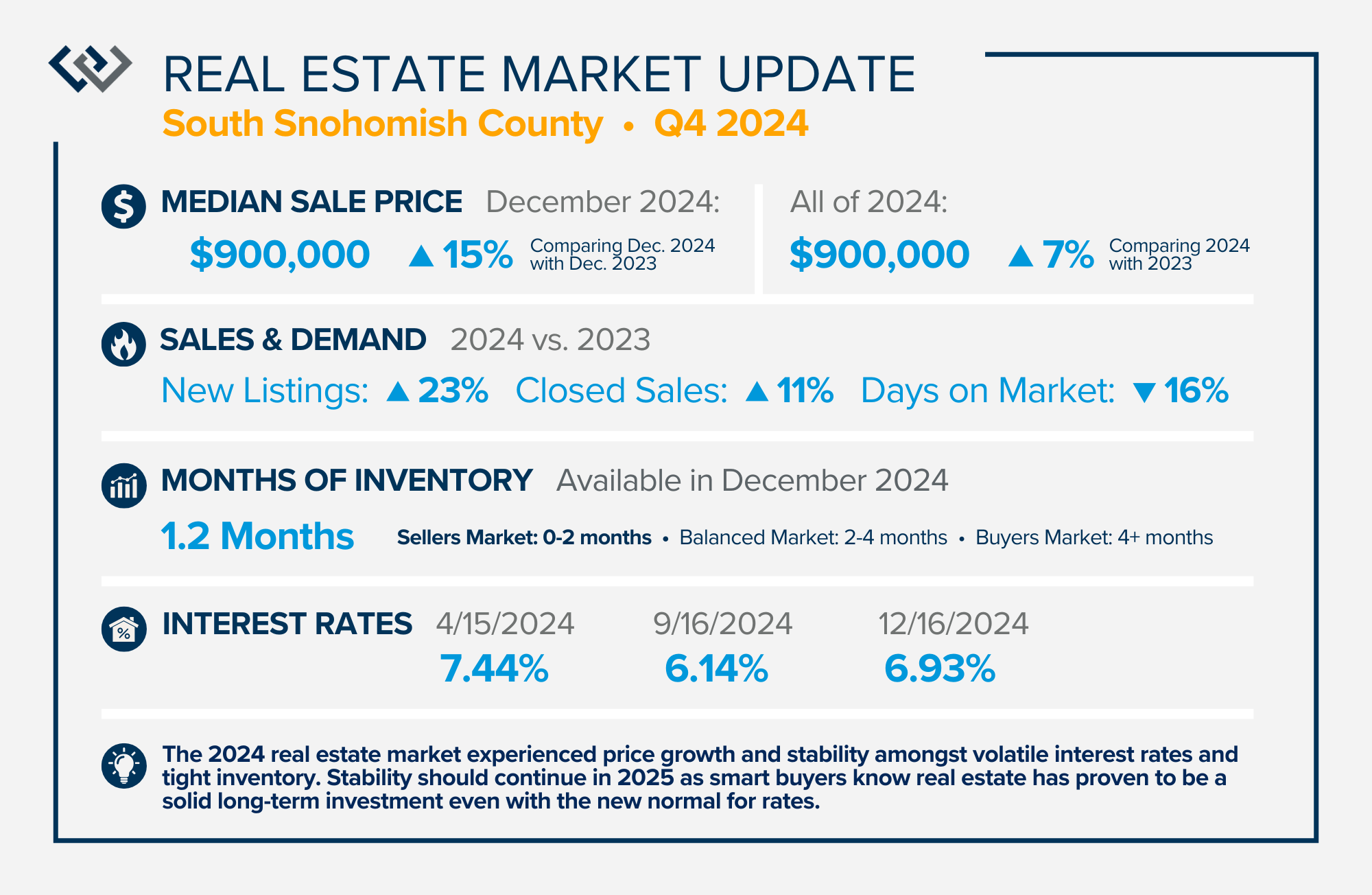

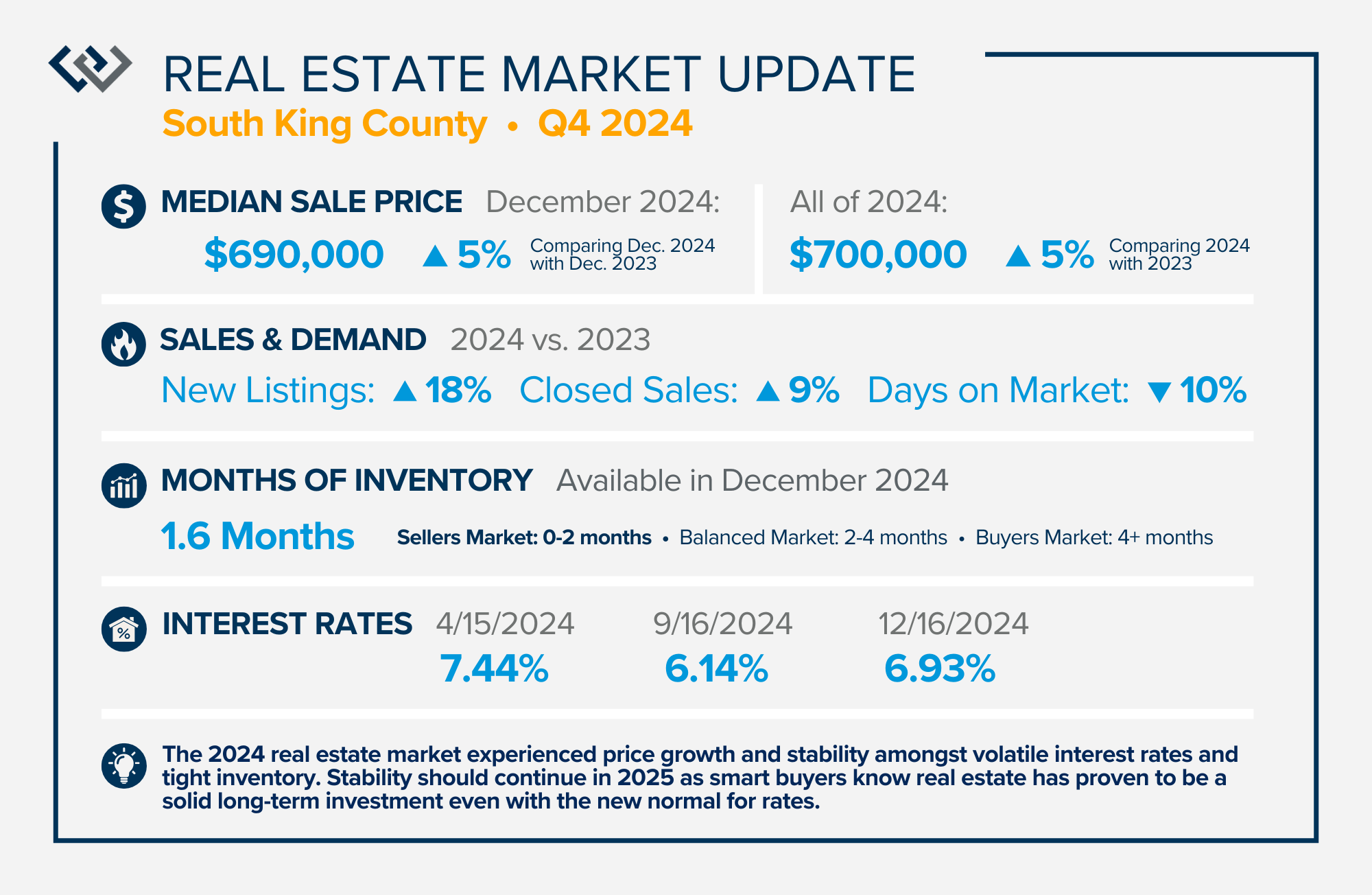

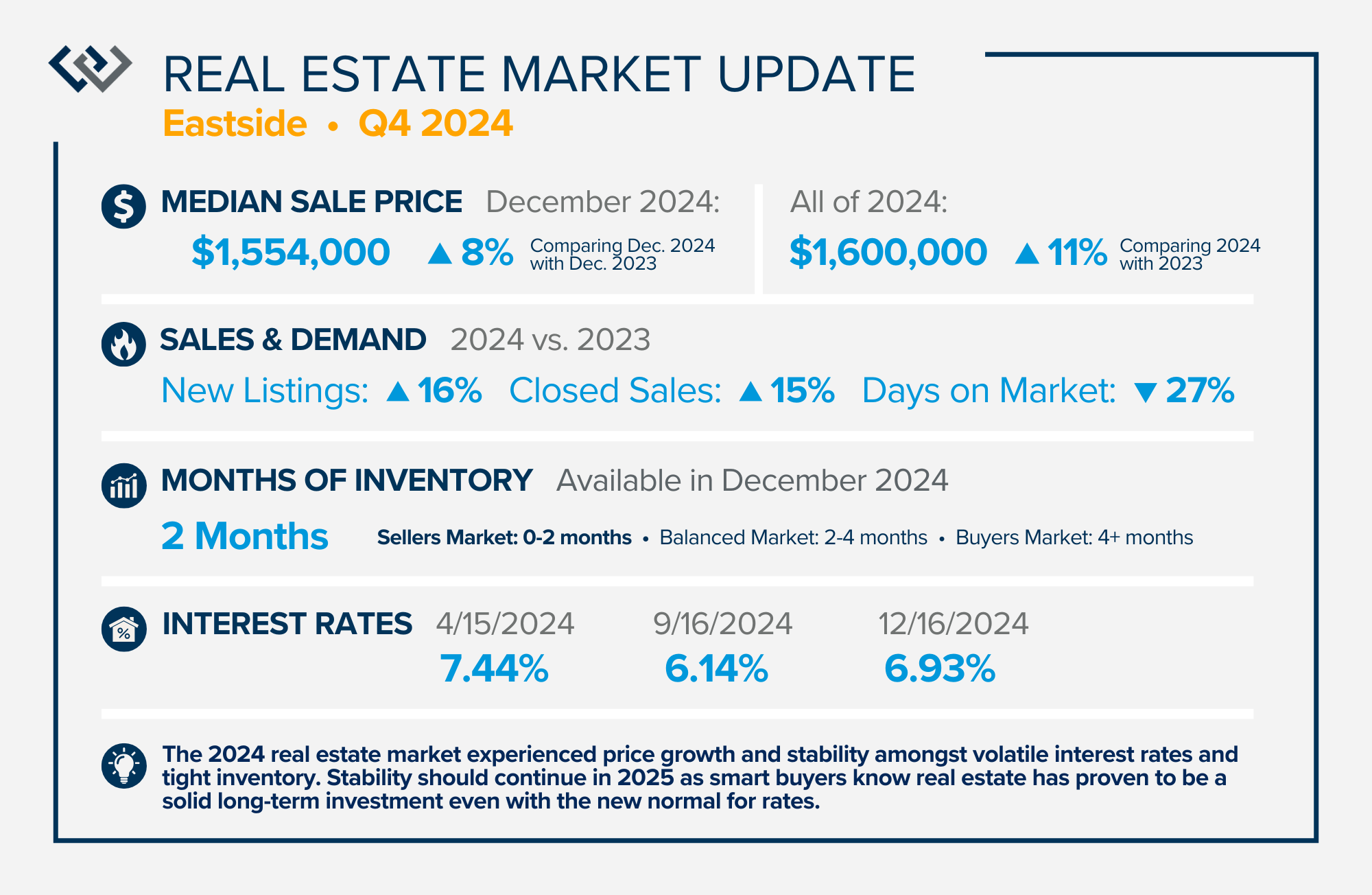

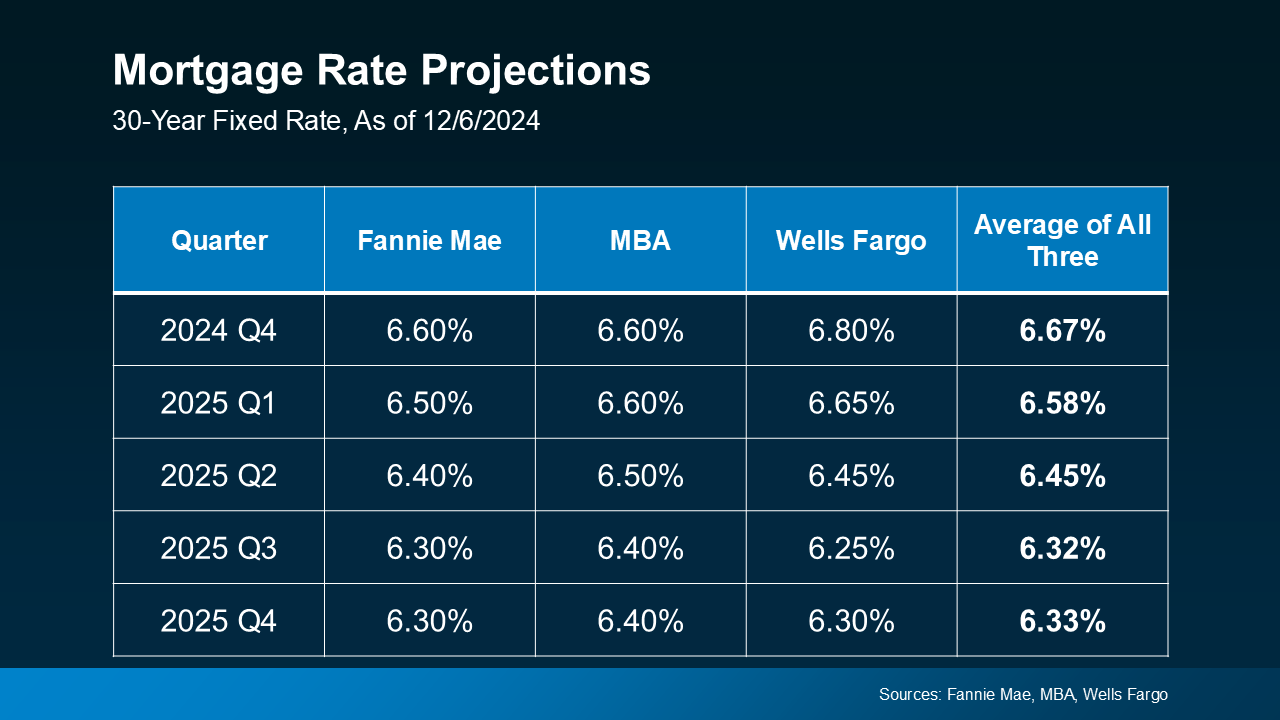

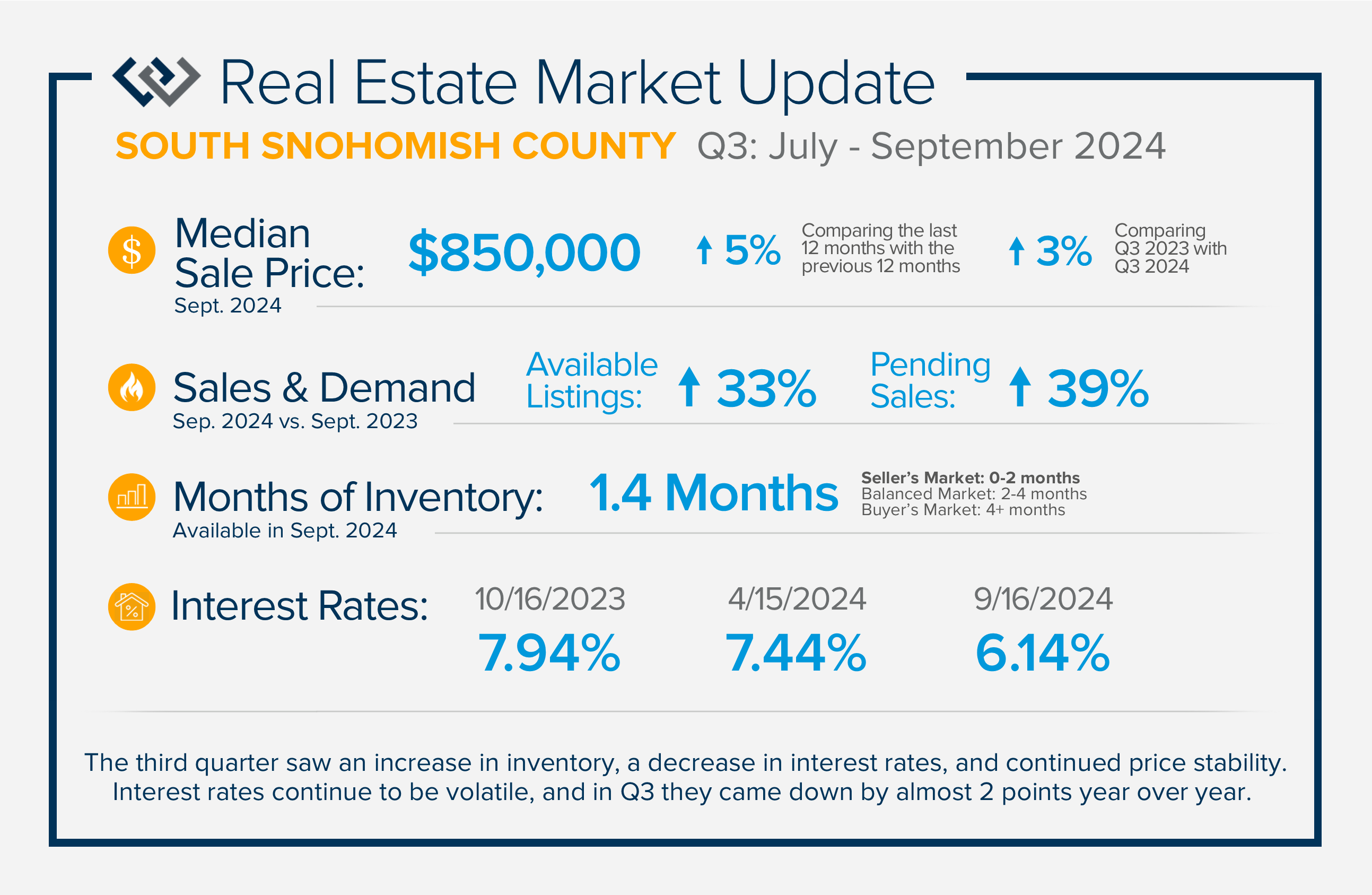

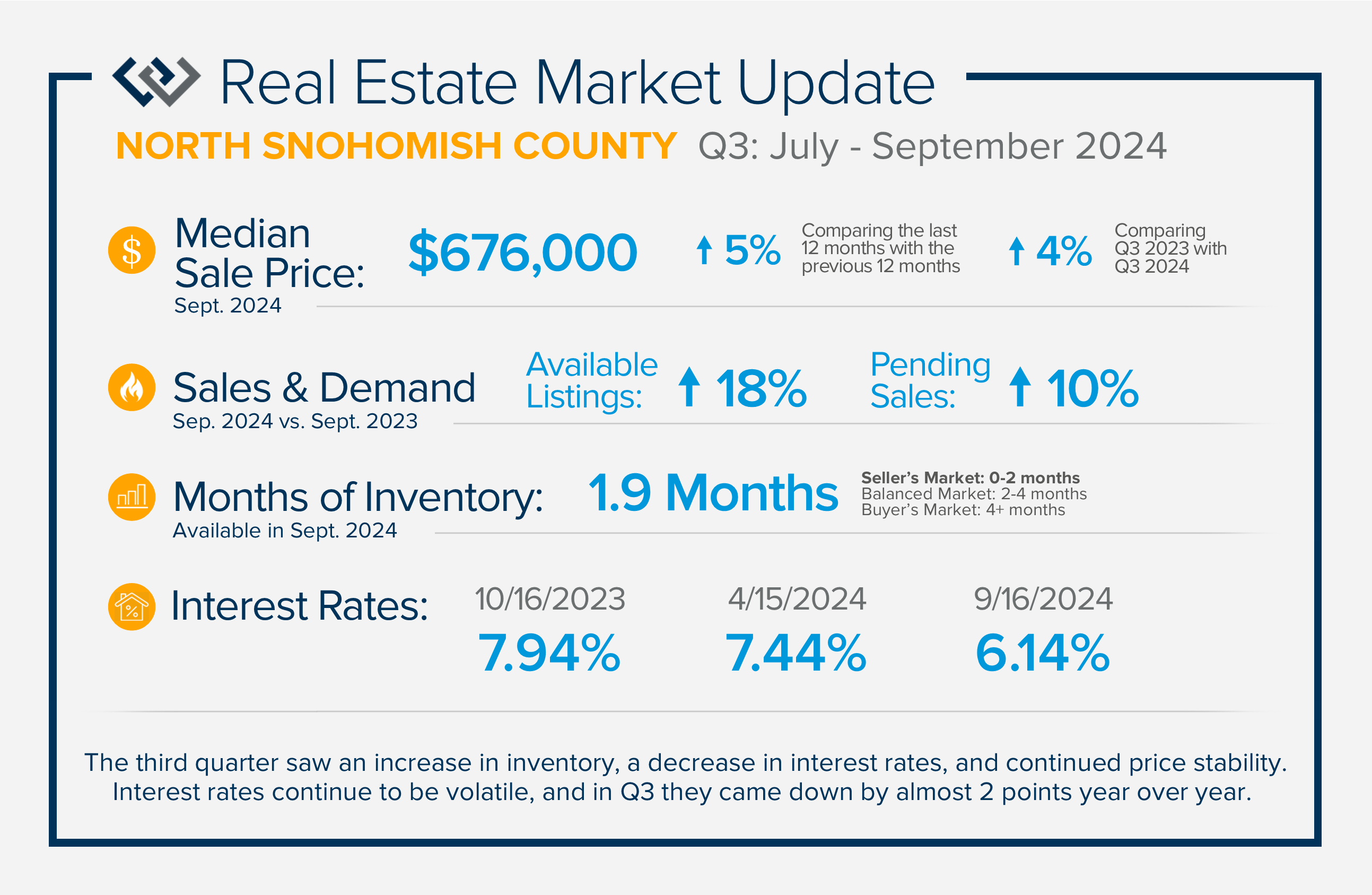

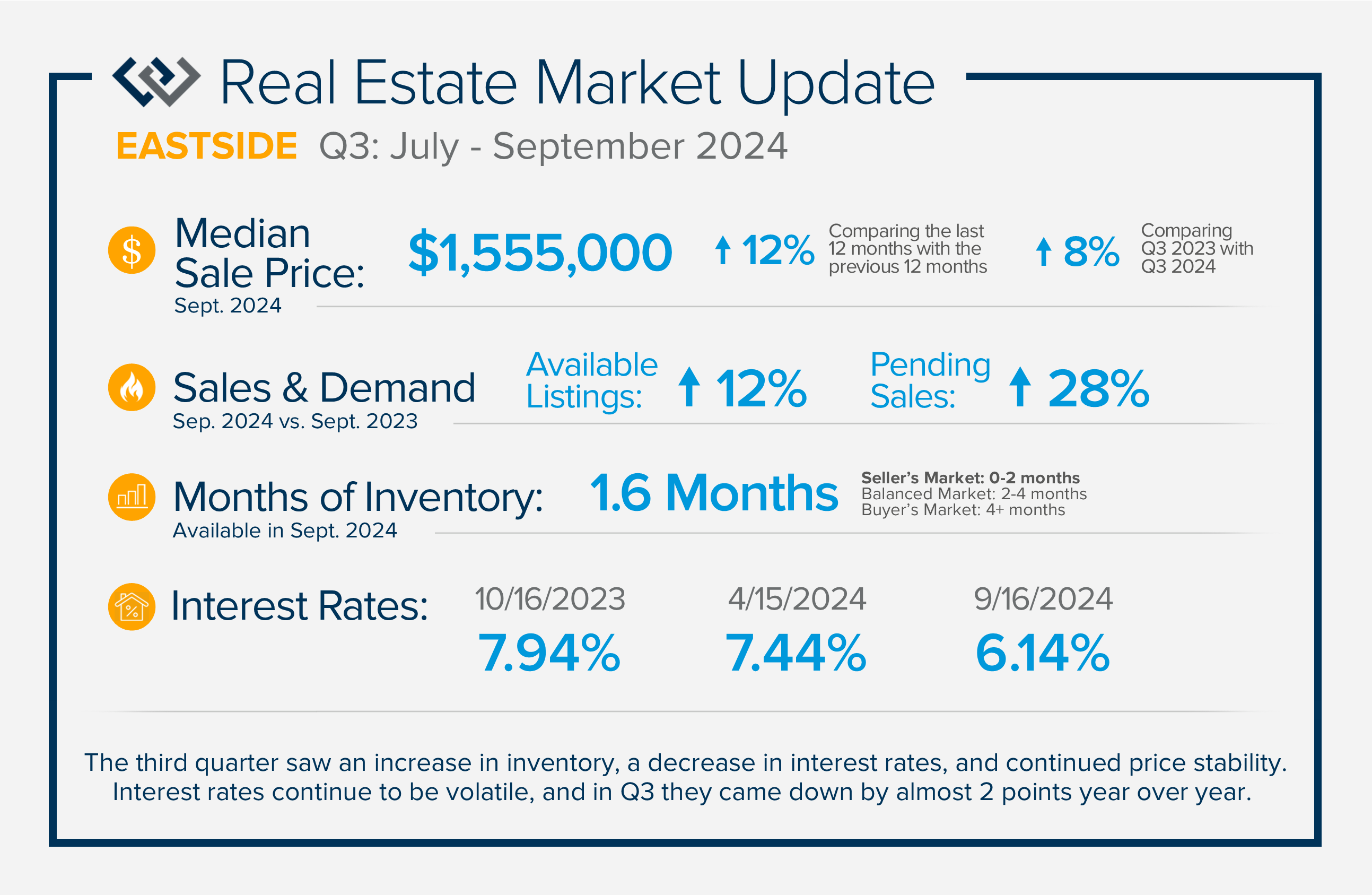

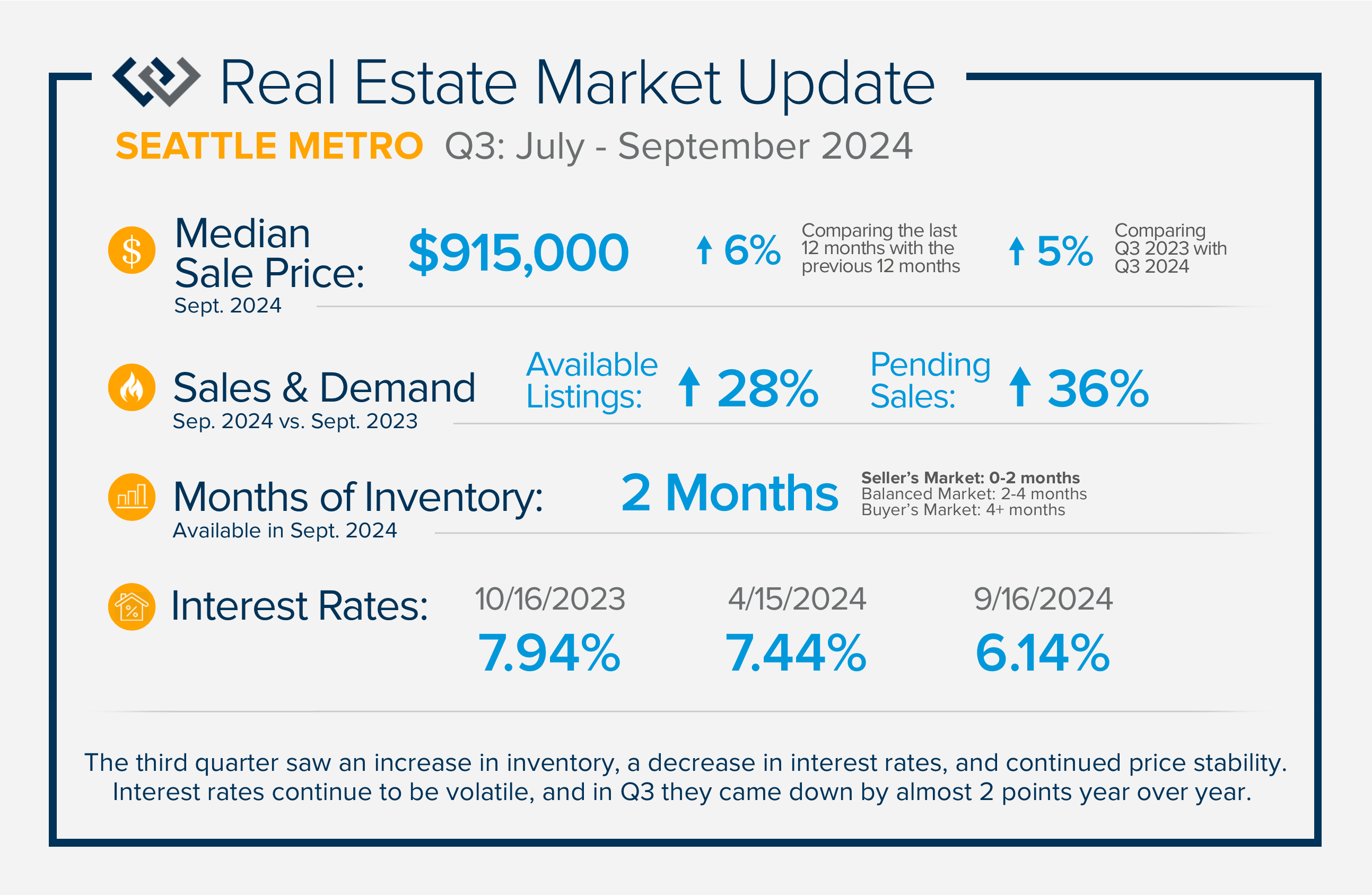

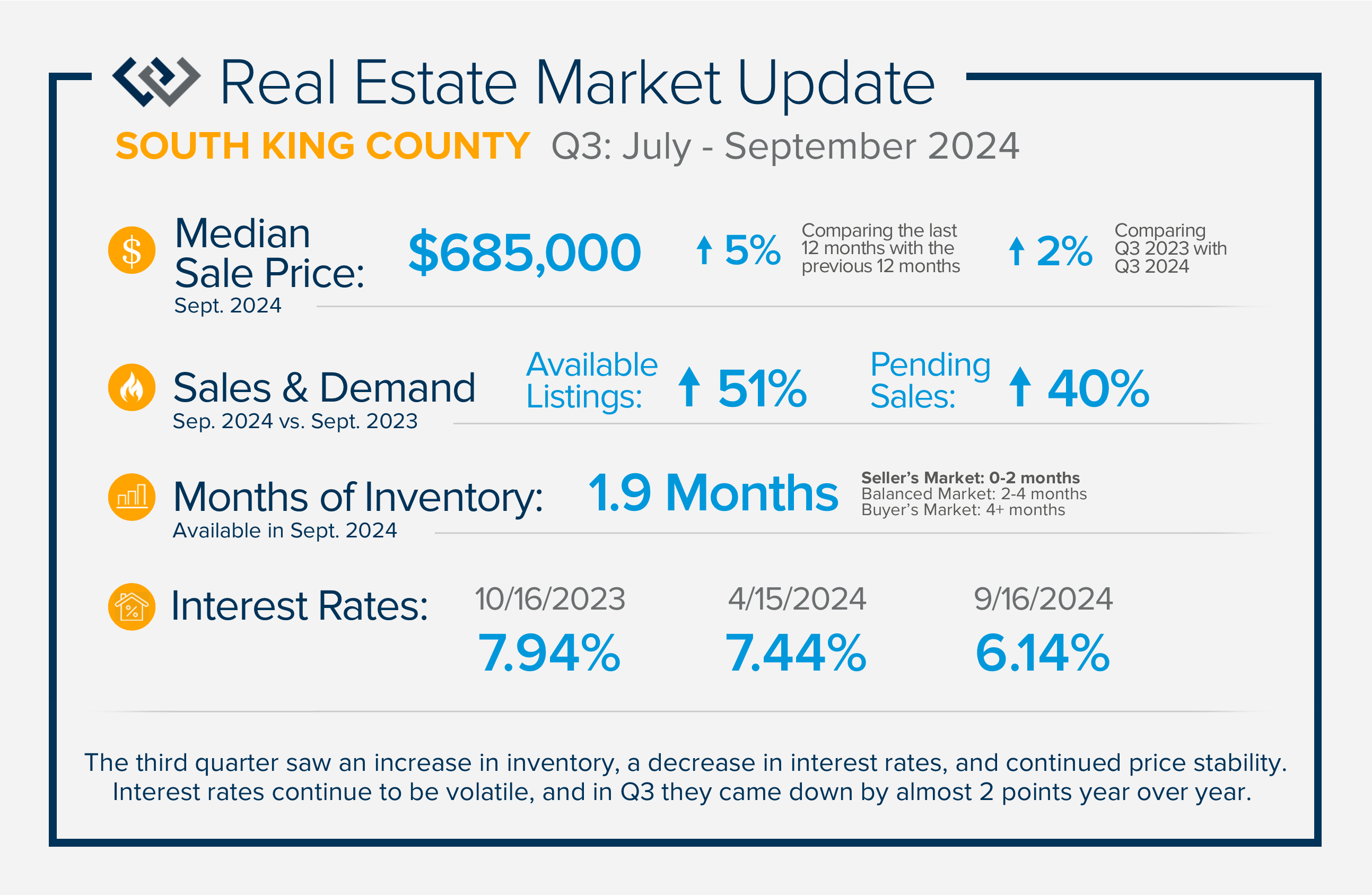

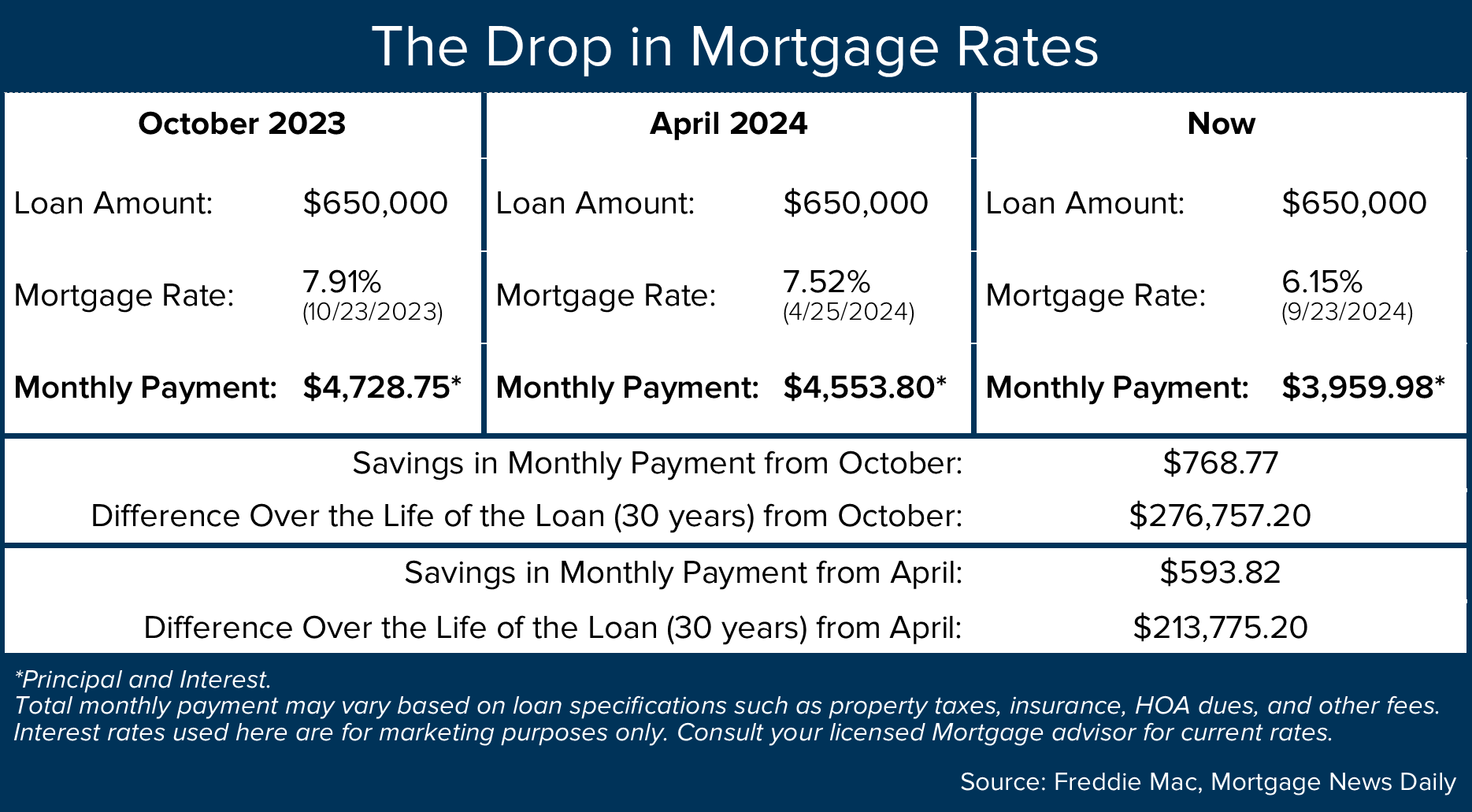

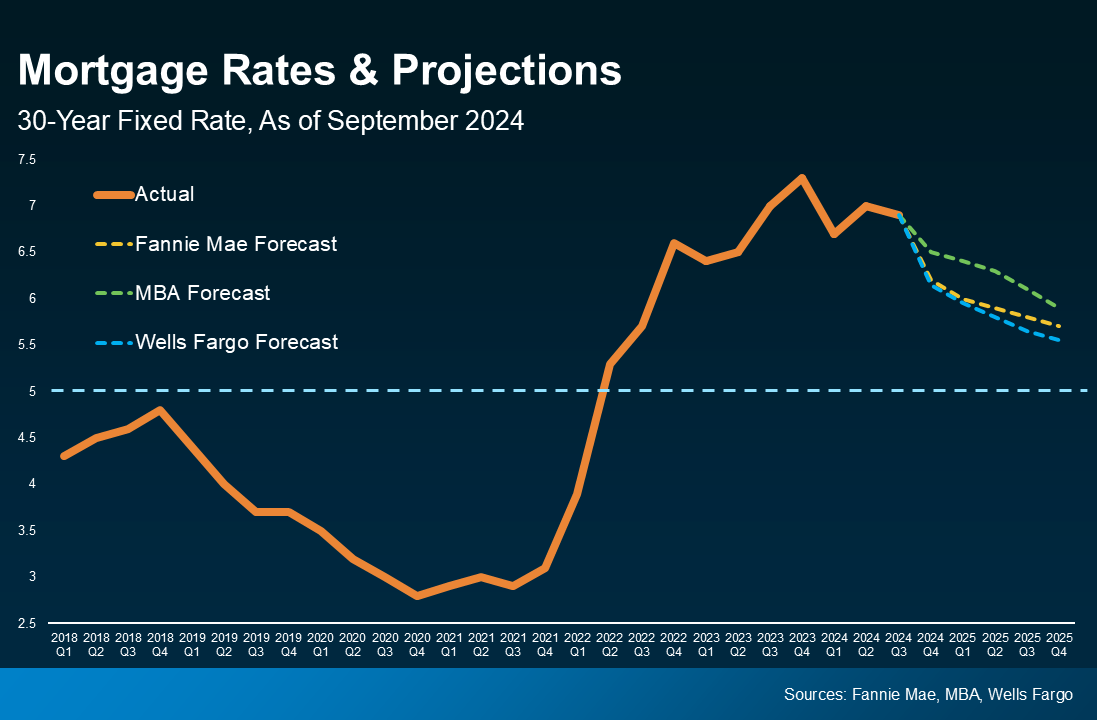

This recovery all happened amidst interest rates peaking at 7.91% in Oct 2023 and never going under 6% the entire time. Rates have hovered from 6.75%-7.25% over the last year, outside of a small window in the Fall when they were in the mid-6%. This illustrates that the market has become accustomed to the new normal of interest rates, and prices have been strong and stable. Tight inventory has helped bolster price stability and growth with limited supply to fuel demand.

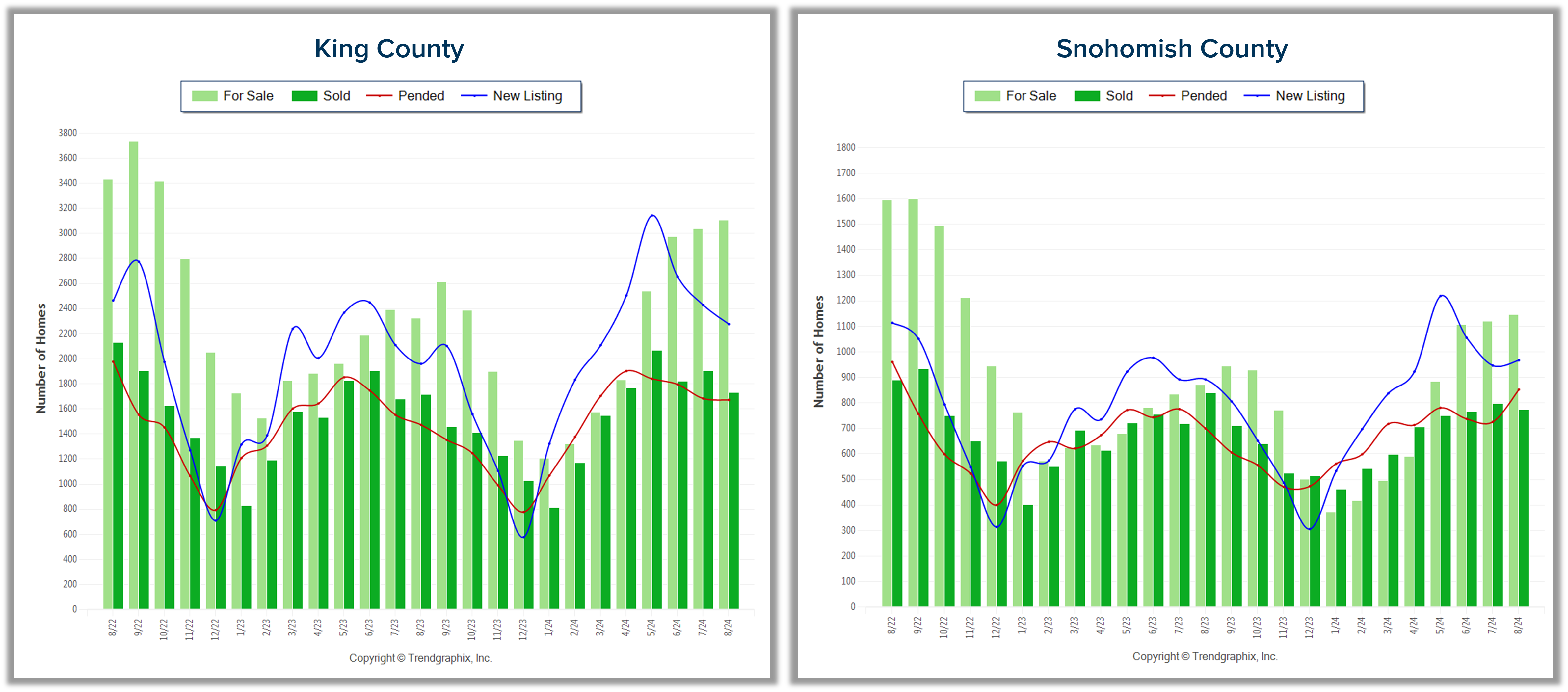

If you look at the recovery from May 2022 to May 2024, you must also understand the seasonality of the market. This pattern has rung true for decades and has much to do with inventory levels. We typically start the new year with the lowest amount of available homes for sale due to the holiday slow down, short, dark days, and many families timing their moves around the school year. Once the new year starts, would-be buyers hit the market with their housing goals blowing wind into their sails.

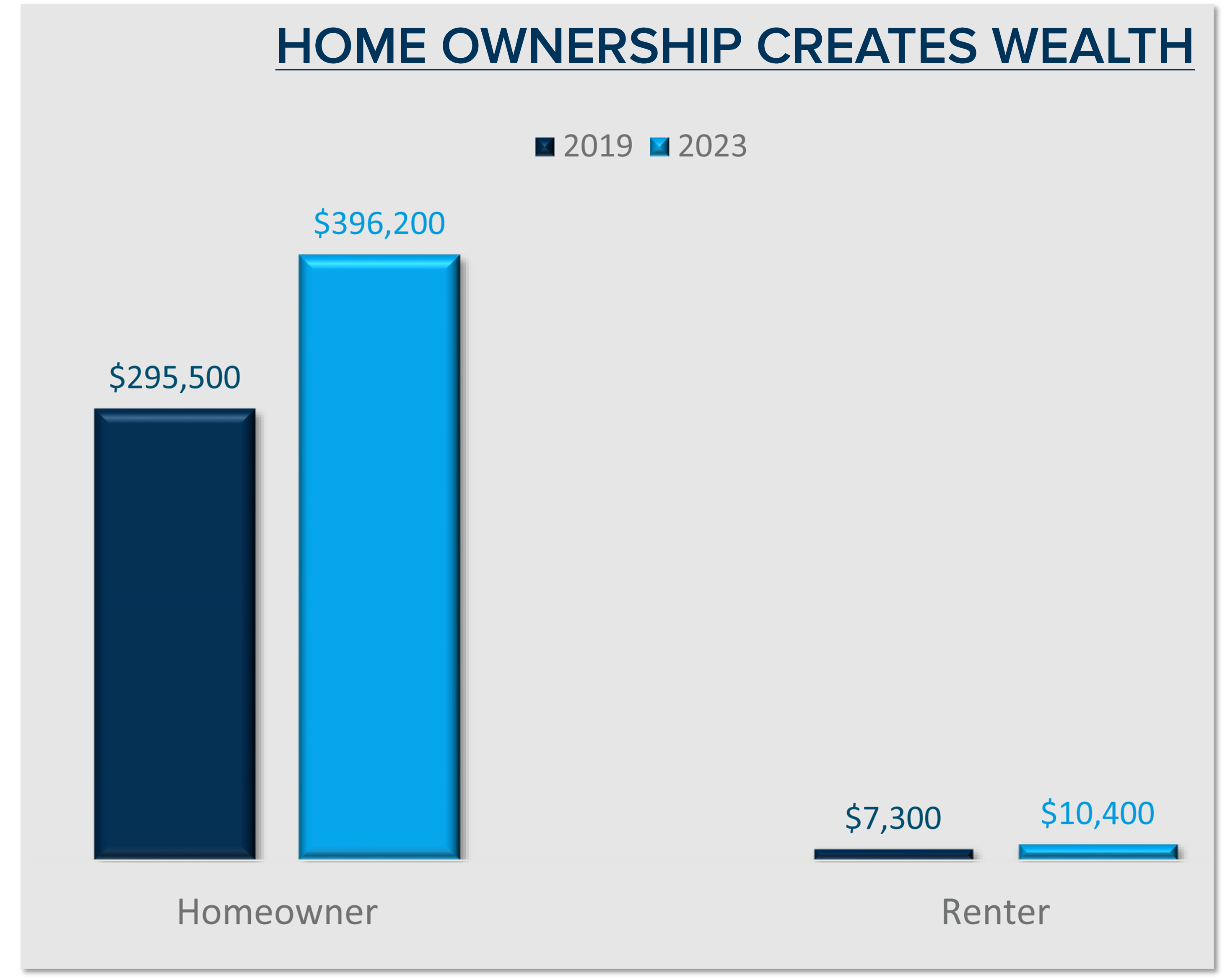

This new demand is coupled with tight inventory, and the price growth for the year starts to take shape via price escalations via multiple offers. This becomes commonplace in Q1, and we begin to see inventory catch up in Q2 when the days are longer, the flowers are in bloom, and we are a little closer to the opening of summer break for schools, creating a less disruptive move. Despite the correction in 2022 and rates stubbornly remaining in the 6-7% range, sellers have realized incredible gains, and buyers who have made purchases have secured their trajectory of building wealth through owning real estate.

Even though price growth is more accelerated in the first half of the year, the deceleration of price growth sits on the shoulders of the gains in Q1 & 2, ultimately leaving prices higher year-over-year. This is a pattern we have seen for some time, and we are already starting to see it unfold in 2025. Month-to-date prices are up in February 2025 over January 2025 by 5% in King County and 1% in Snohomish County. This pattern can guide one’s timing of the market, and so can life. As much as hitting the perfect week when there is less competition and rates drop may feel like hitting your bet at the roulette table, making a move is much more nuanced than that. The timing of a move needs to work with the demands of life, and the good news is the year-over-year gains are positive regardless.

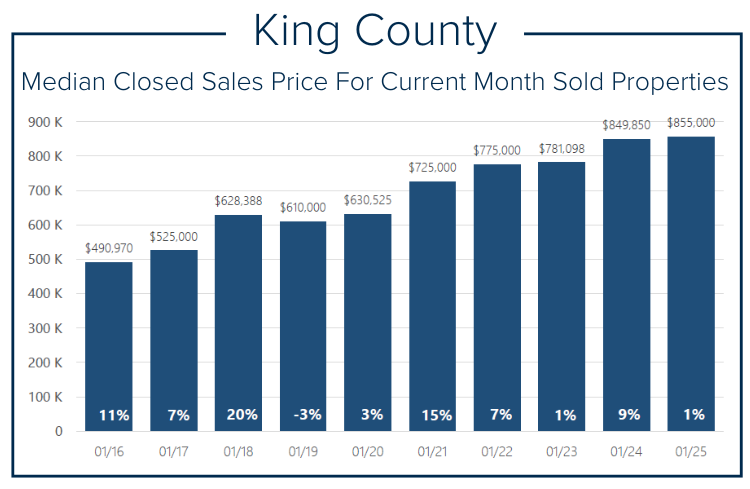

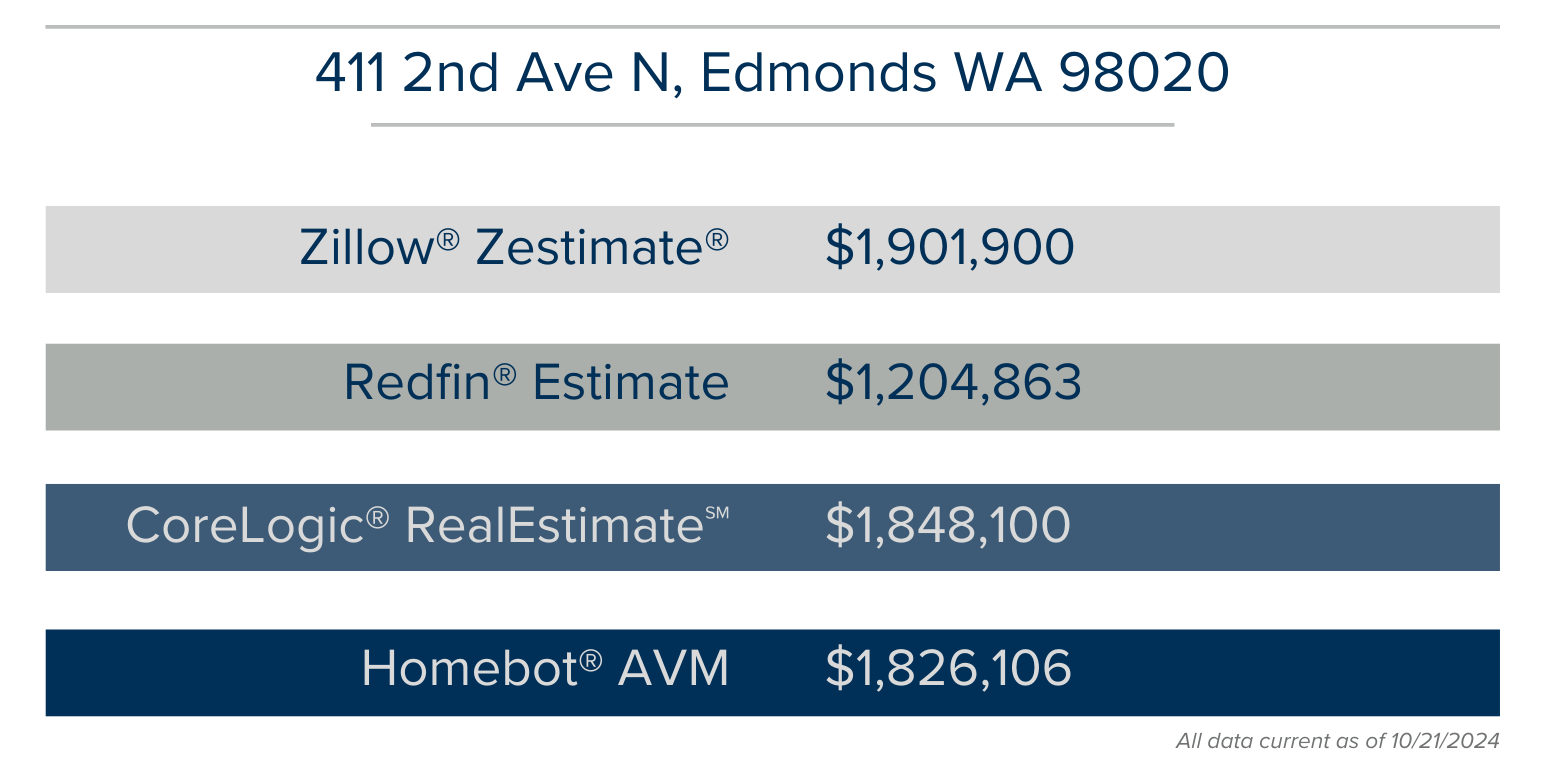

As we head into the spring market for 2025, we anticipate additional price growth from where we are now and following the trend of prices peaking in late Spring. We should regain and most likely eclipse the peak prices we saw in 2024. To expand this to the bigger picture, let me share some fun facts about long-term price growth and homeowner equity with you. This is especially important as real estate is a long-term investment, the four walls where you create your life, and not meant to be a lucky bet on black.

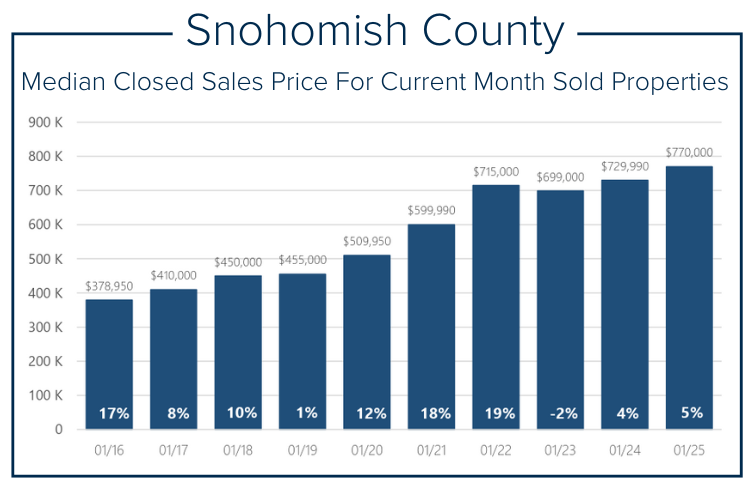

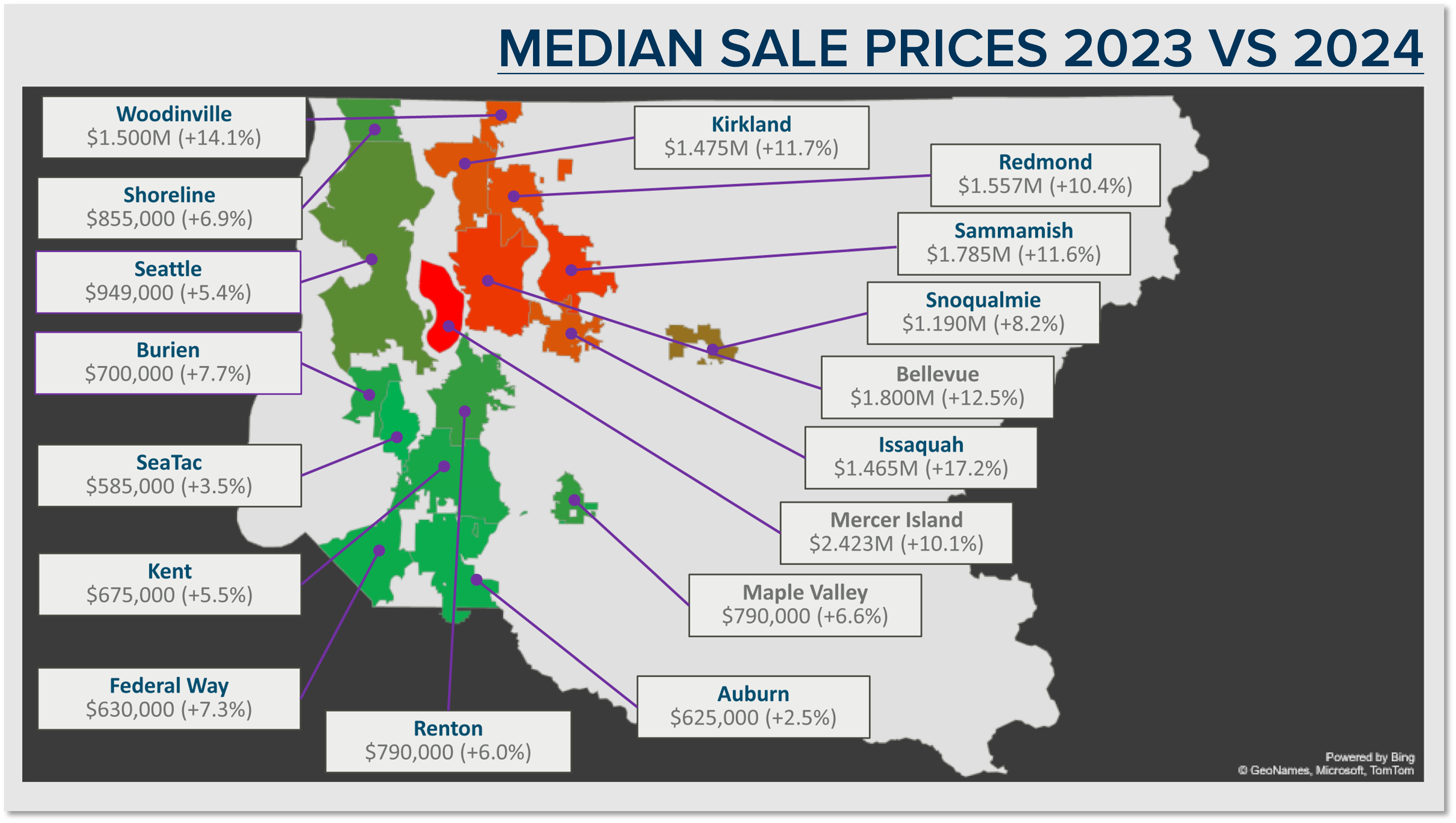

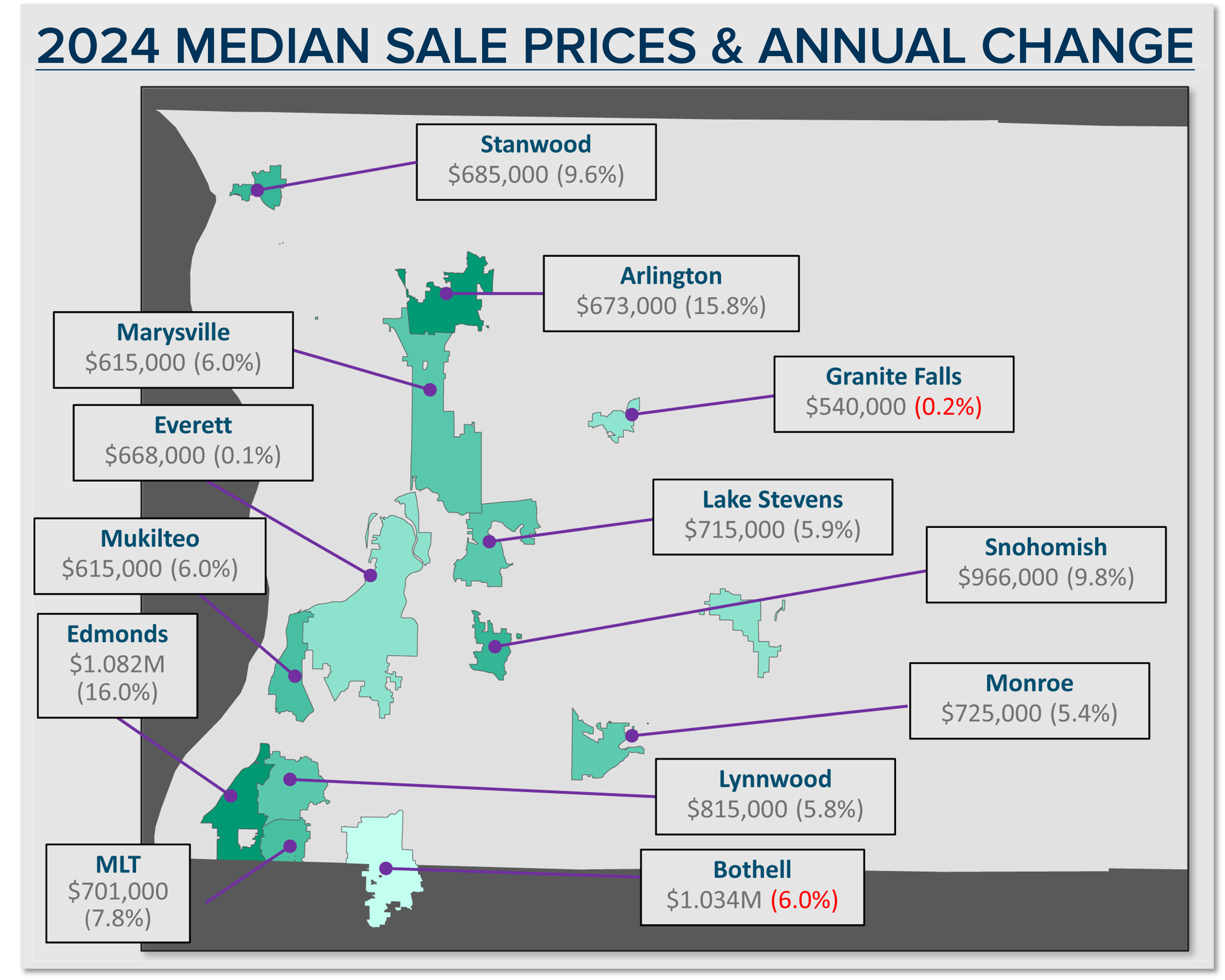

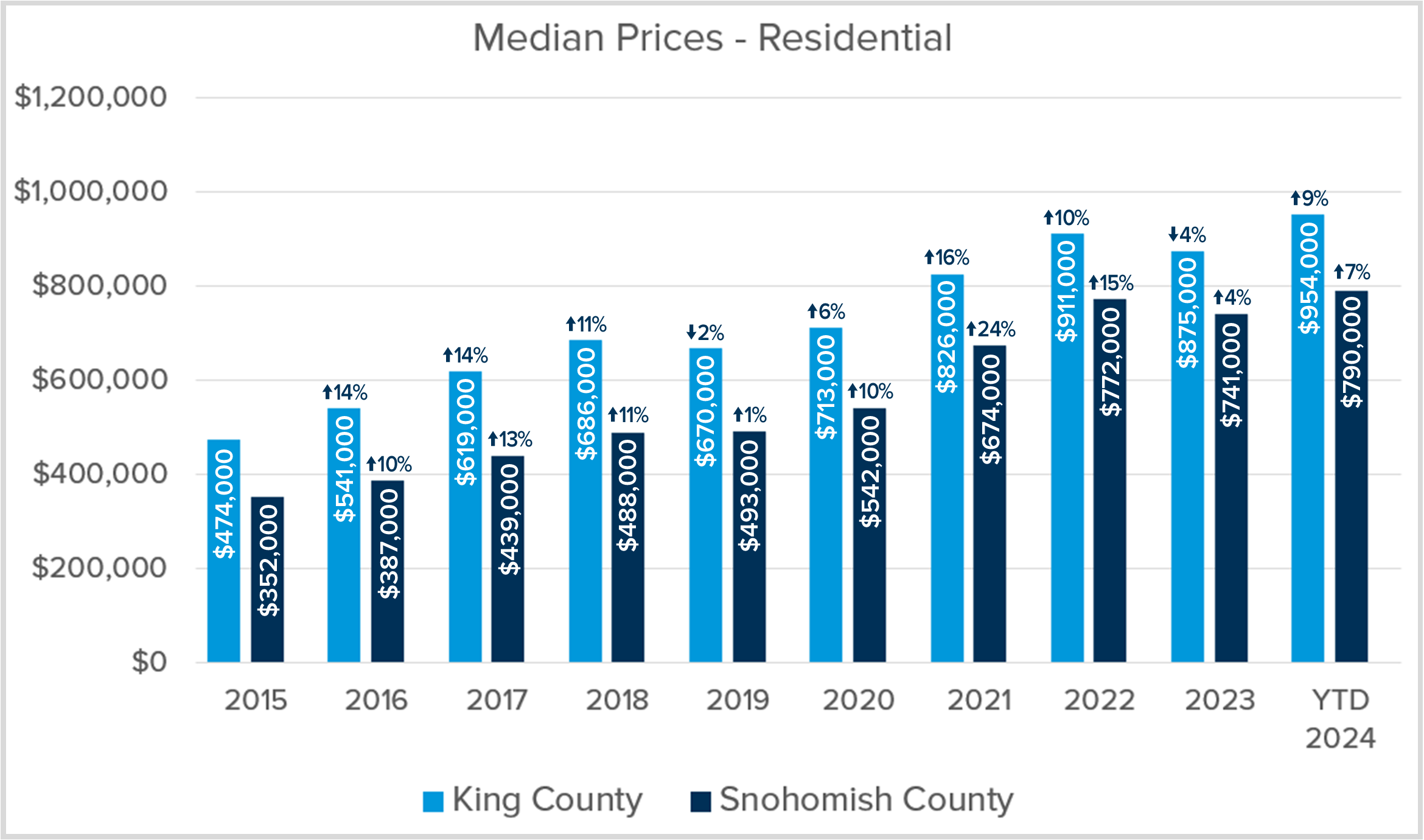

Check out the charts below that show how far prices have come over the last ten years! In King County, the January median price is up 74% since 2016 and up 36% since 2020. In Snohomish County, the January median price is up 103% since 2016 and up 51% since 2020. Equity levels are high across our region, with over 50% of homeowners having 50% equity or more. Many homeowners are in the fortunate position to reposition their equity into a home that is a better fit for their lifestyle if they are experiencing life changes such as a change in family size, job change, or a financial shift.

I hope this look back to look forward instills confidence in our real estate market and home values. If a move is in your future, you will prosper well. Please reach out if you or someone you know is considering a move, whether it is a purchase, sale, or both. I can help apply these facts and figures to your specific market area and help chart a plan according to the market conditions and your goals. It is always my goal to help educate my clients and empower them with the information to make well-informed, strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link