As we approach November and the Presidential election nears, it would be good to look back on how election years have historically affected the real estate market. There is certainly a lot going on and this stimulation can cause pause. Buying and selling real estate is a big life event and the election is a big national event. Some buyers and sellers will delay their moves until after they know how the election is going to pan out. Sometimes this delay is caused by pure distraction and sometimes there is a level of uncertainty that is created until a decision is made.

Here is some interesting data that illustrates the trends of consumer behavior surrounding a Presidential election. Interest rates, the rate of home sales, and price growth are all analyzed below. Looking back to look forward provides some concrete evidence of how a Presidential election can affect the performance of the housing market.

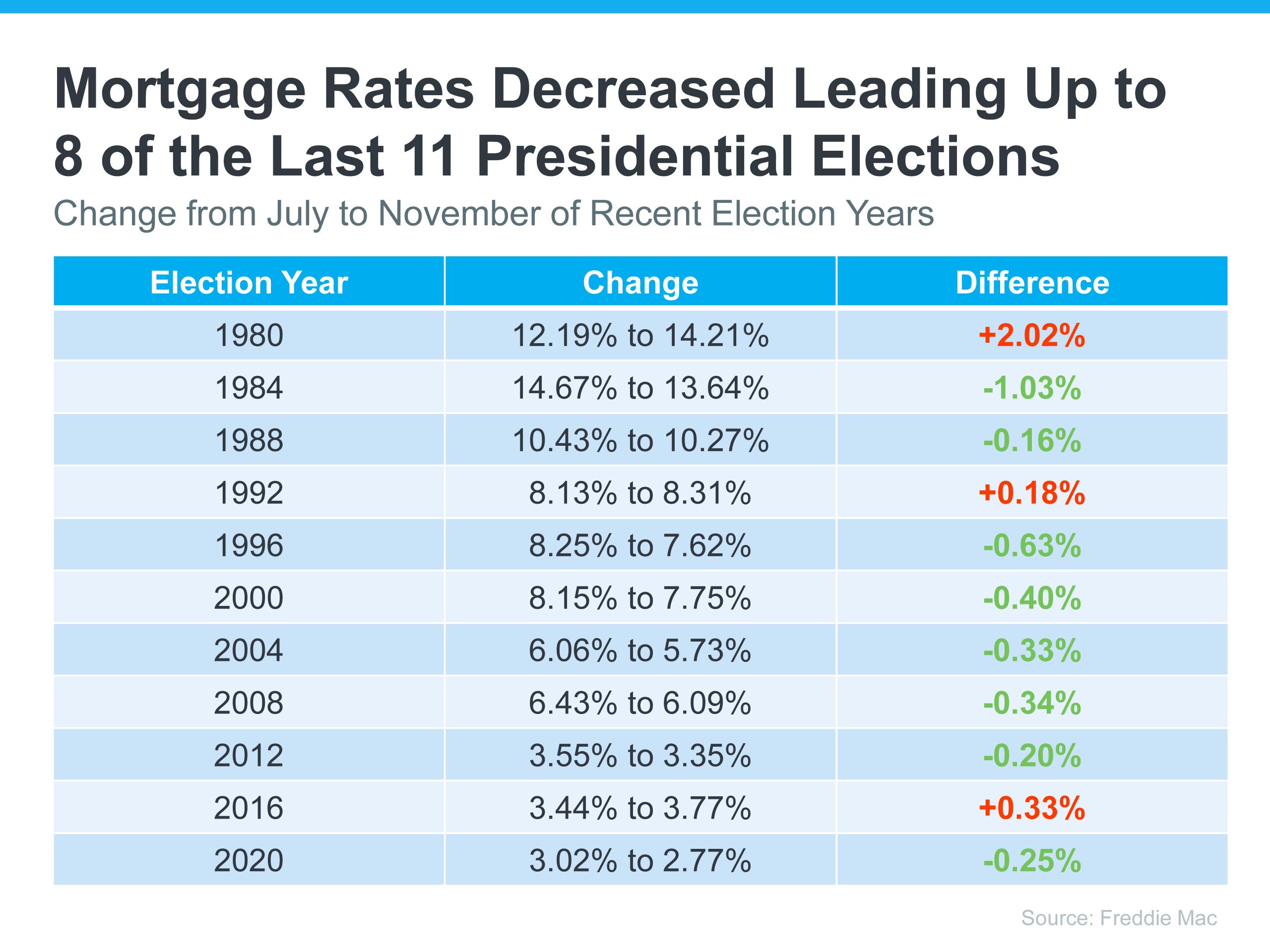

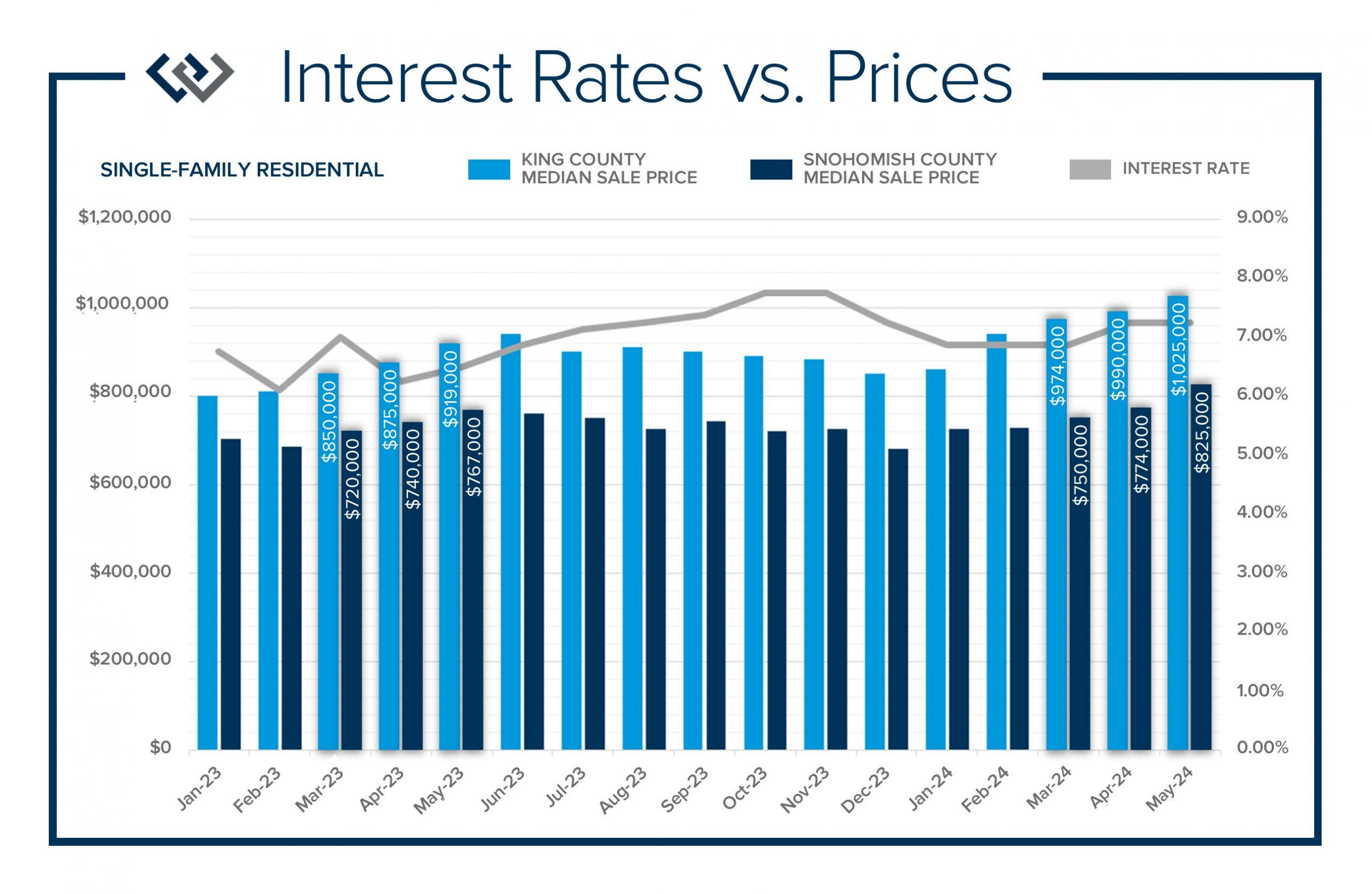

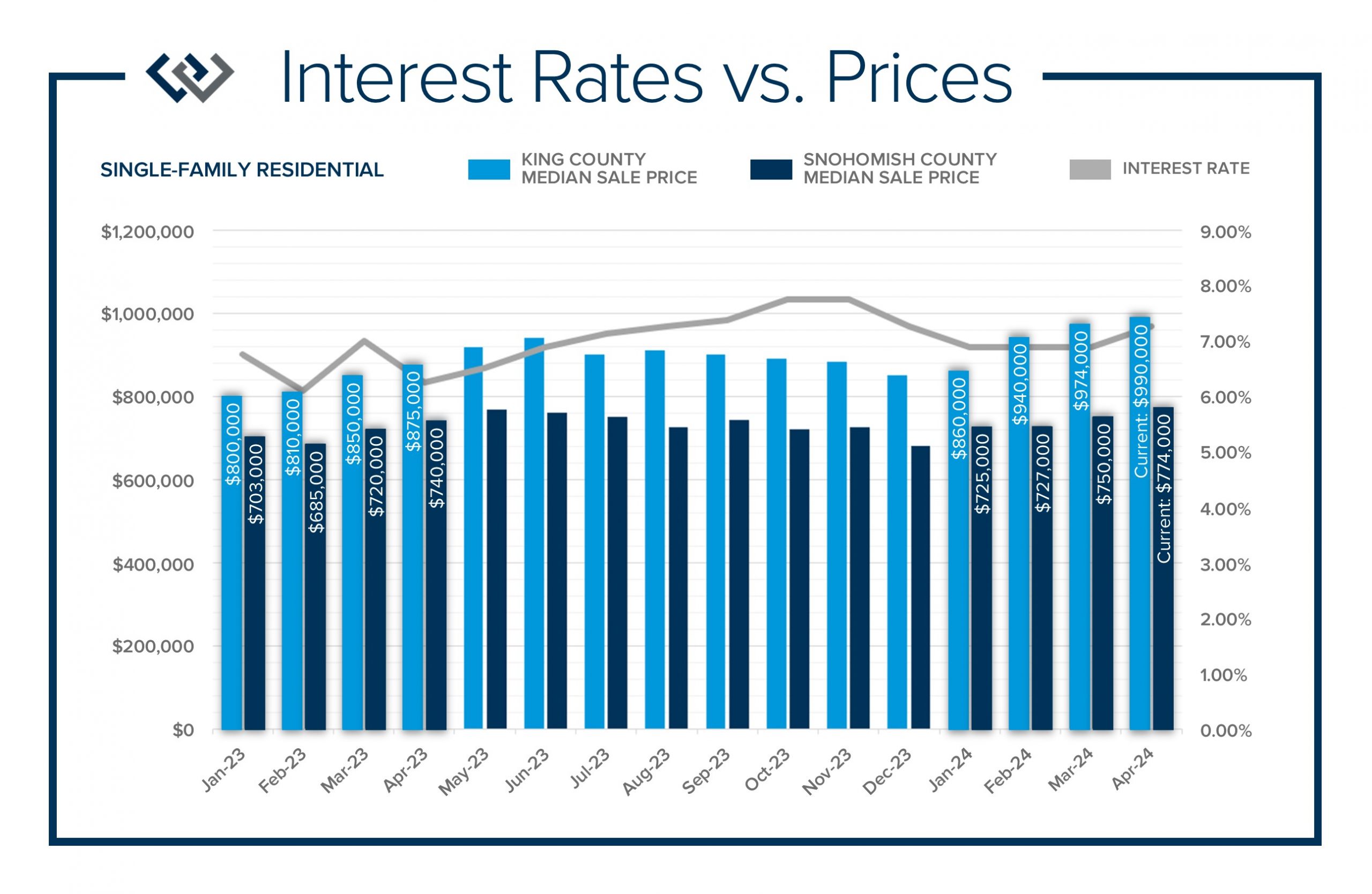

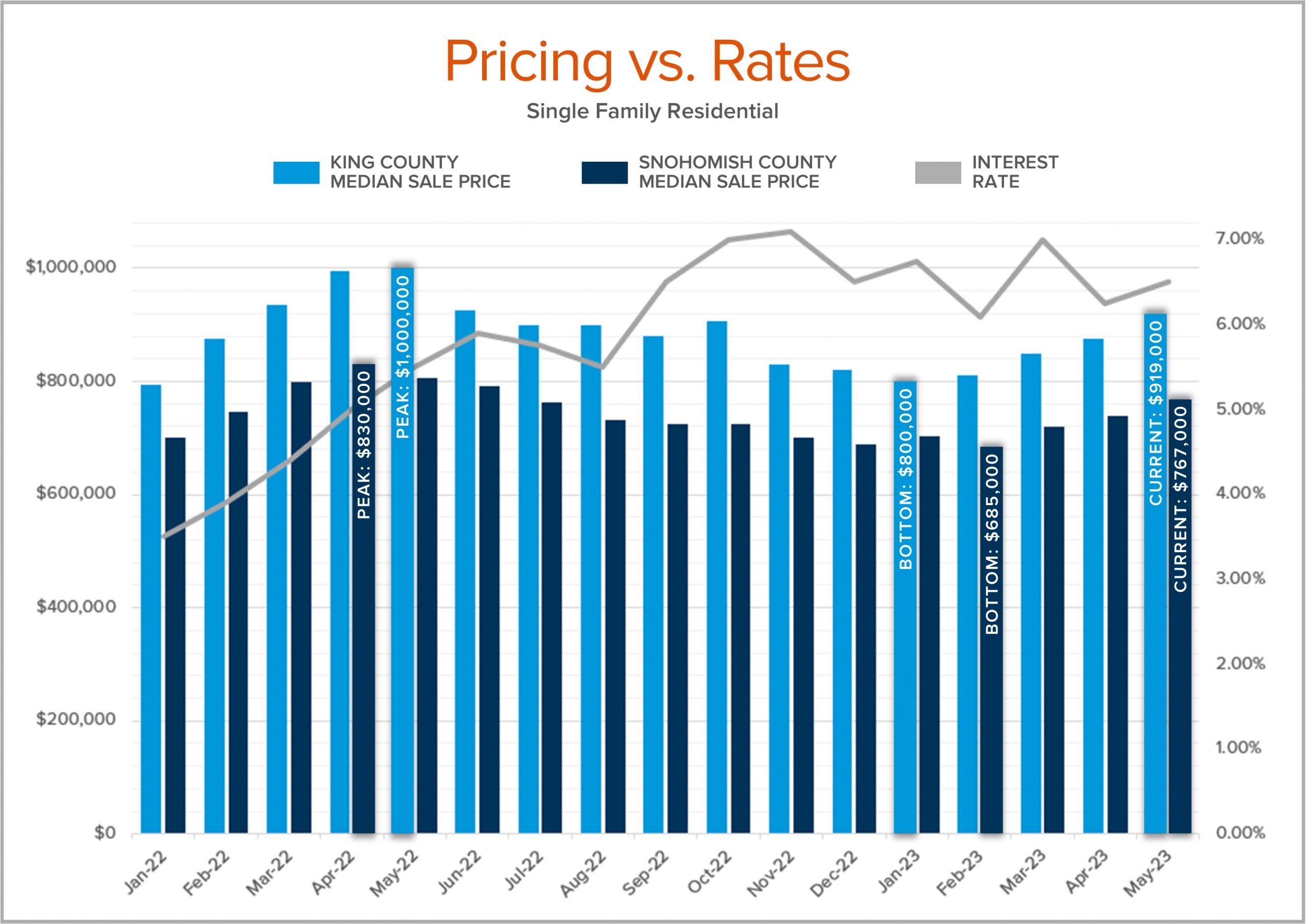

First, interest rates! We have recently experienced a nice drop in rates. Rates have been extremely volatile over the last two years. Last October, rates peaked at almost 8%, came down to 6.75% in January 2024, went back up to 7.4% in April 2024, and have recently dropped to the lowest level we have seen since April 2023 and are hovering around 6.5%. This is largely due to inflation finally settling and a recent jobs report showing increased unemployment. This trend is predicted to continue as the Fed considers a rate cut in September with the plan of easing rates as we finish 2024 and head into 2025.

The chart below shows what rates have done over the last eleven election cycles and it certainly looks like the current trend with rates follows historical norms. This is an opportunity for buyers to jump into the market as this reduction in rate is accompanied by an increase in inventory. With lending costs lower and more selection buyers could even find themselves in a position to negotiate a further reduction in rate to help with the overall affordability of a purchase.

The market is very much driven by what a buyer’s monthly payment would be. Lending costs are a huge factor that will play into consumer confidence and the amount of sales happening. Further, we expect more home sellers to come to market as rates ease as they will be more inclined to give up their low rate to move to a home that is a better fit for their lifestyle.

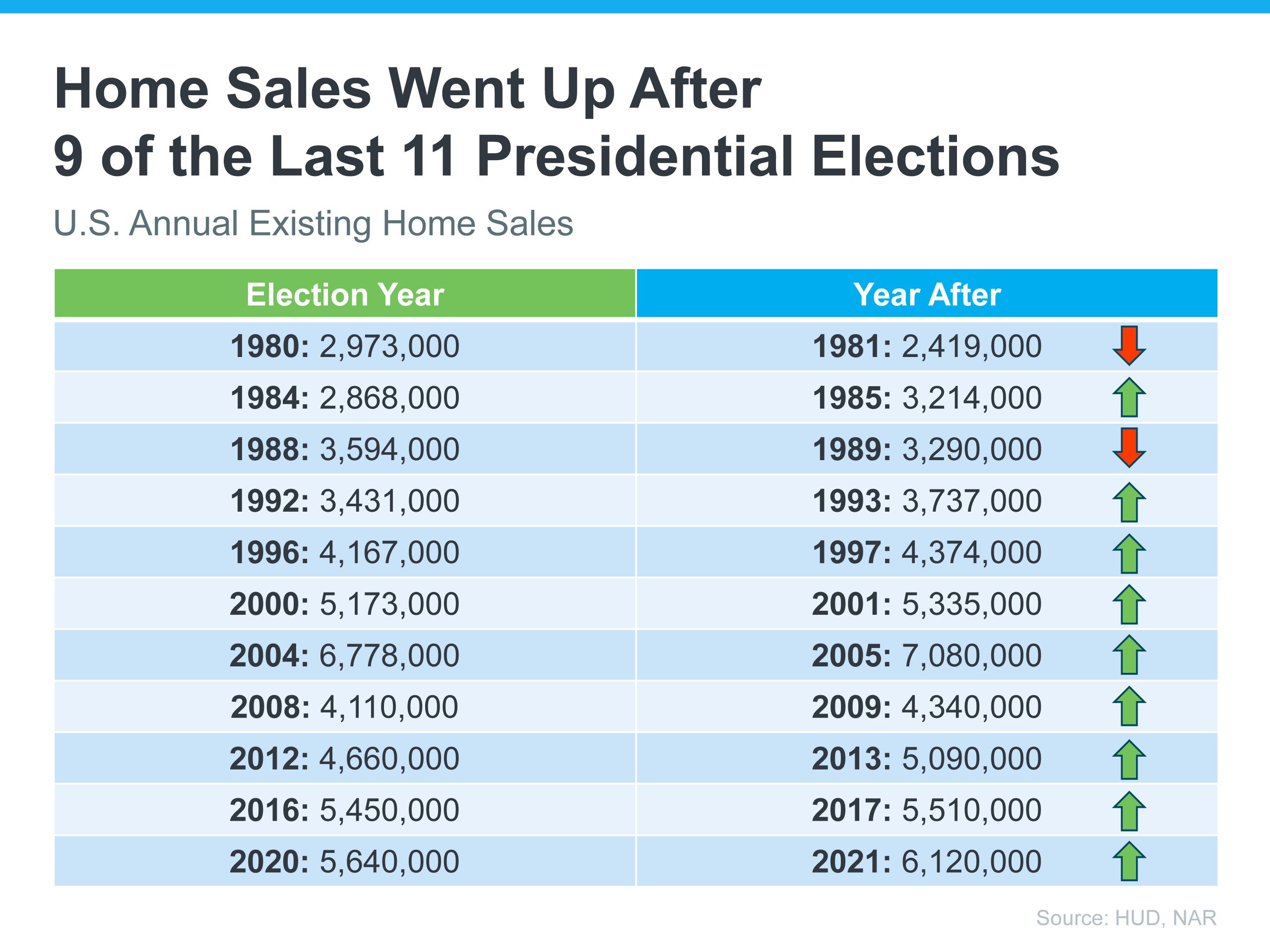

The chart below shows the increase in home sales in nine out of the eleven past election cycles. In fact, the first year after an election is historically robust with activity. If history repeats itself in 2025, buyers who are ready may want to consider making a move now. With the dip in rate, increased selection, and some buyers sidelined it could be a great time to make a purchase with a little less competition.

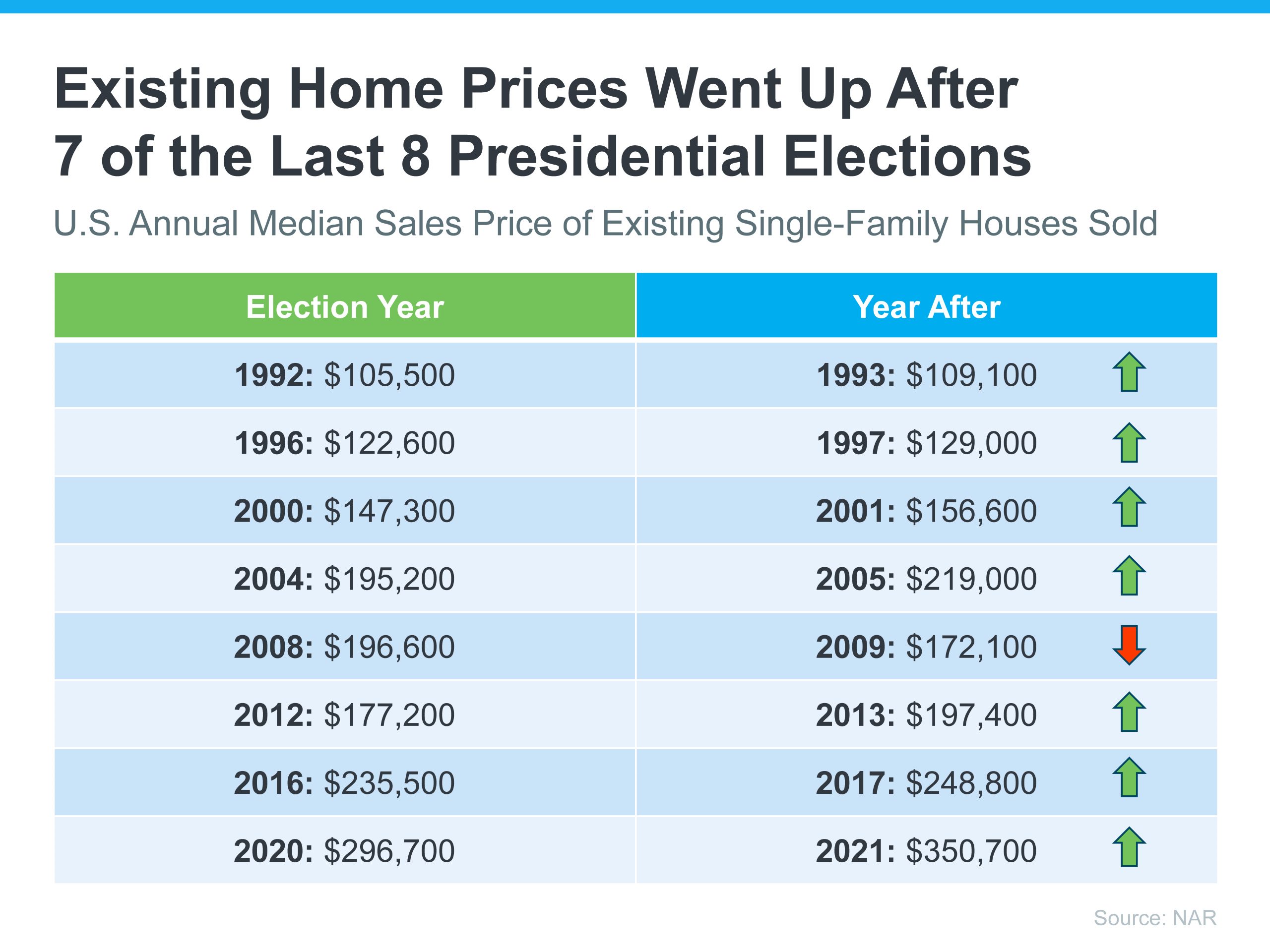

Even better news is that historically prices increase after an election year. In seven out of the last eight post-election years, prices increased. The only year they did not, was 2008 which was in the hollows of the Great Recession. Of course, we will not be able to measure this until a year from now and this will be something that I will be paying close attention to.

So far, 2024 has been a year of price growth. We experienced huge gains in the first half of the year over 2023. 2024 marks the year of recovering from the 2022 post-pandemic correction and re-gaining price stability. Equity levels in our area are very strong with close to 60% of homeowners having at least 50% home equity. We expect the movement of this equity to become more nimble as the cost of borrowing money comes down.

What we have in store over the next three months will be distracting, stimulating, and just a lot. I hope the information above provides some history that helps ground the facts during a time of heightened angst and uncertainty. As always, life dictates changes in real estate needs. If you or someone you know has come up on some life changes that indicate a move would be beneficial, please reach out.

Despite the chaos of the election, you can never plan too early for these big life transitions and there might be some great opportunities amongst the noise. Whether it’s a purchase, a sale, or both, I am equipped to help you assess your goals and help you devise a plan. The best time to make a move is when you’re ready and I’m here to help.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link