2025 has been the year of a power shift in the real estate market, as we experience more balance in the market. Increased inventory has provided the biggest advantage for buyers, giving them more selection, which has tempered price growth and aided affordability. In King County, there were 43% more available listings in July 2025 over July 2024, and 47% more in Snohomish County. This, along with the new normal of interest rates, has buyers who are ready to make a move in a positive position to pounce. We have even seen rates come down close to 6.5% for a 30-year conventional loan and to 6.15% for FHA and VA loans in the last two weeks!

Surprisingly, as we find ourselves in the dog days of summer with many people enjoying the last bits of kids being out of school, taking vacation time, and savoring all the PNW has to offer during the summertime, we have seen buyer activity start to increase. Month-to-date this August, pending sales are up over July 2025 by 9% in King County and up 17% in Snohomish County. This is on the heels of pending sales leveling out in King County in July 2025 over June 2025 and increasing by 12% in Snohomish County. With 36% more homes for sale in King County YTD and 41% more in Snohomish County, buyers are starting to understand the opportunity increased selection brings. According to the Mortgage Bankers Association (MBA), mortgage applications are also up year-over-year.

The increased selection has created more room for buyer negotiations and further opportunity to perform due diligence. Compare this to the previous onslaught of bidding wars, buyers now have a calmer environment to make big decisions. We have even seen the return of successful home sale contingencies when the right situation presents itself. Basically, the market has become more fluid and less of an uphill battle for buyers to secure a home. Evidenced by the average list-to-sale price ratio for a home in King and Snohomish Counties in July, at 98%. Last July, when there was less selection, the average list-to-sale price ratio was 100% in King County and 99% in Snohomish County. With that said, we are still seeing homes that are brought to market that are well priced and in prime condition getting multiple offers and selling for over list price. It is just no longer the norm and more so the exception.

This has resulted in median price growth becoming flat, but not faltering. In King County, the median price is up 1% this July over July 2024, and is equal in Snohomish County. Further, when you calculate the average median price over the last 12 months in King County and compare it to the previous 12 months, median price is up 4% in both King and Snohomish Counties. We are nowhere near a free fall in prices; what we are experiencing is a deceleration in price growth. Since this has followed the unprecedented double-digit, year-over-year price growth we saw during the pandemic, some may see this as the sky is falling, which is simply wrong. This is a good thing!

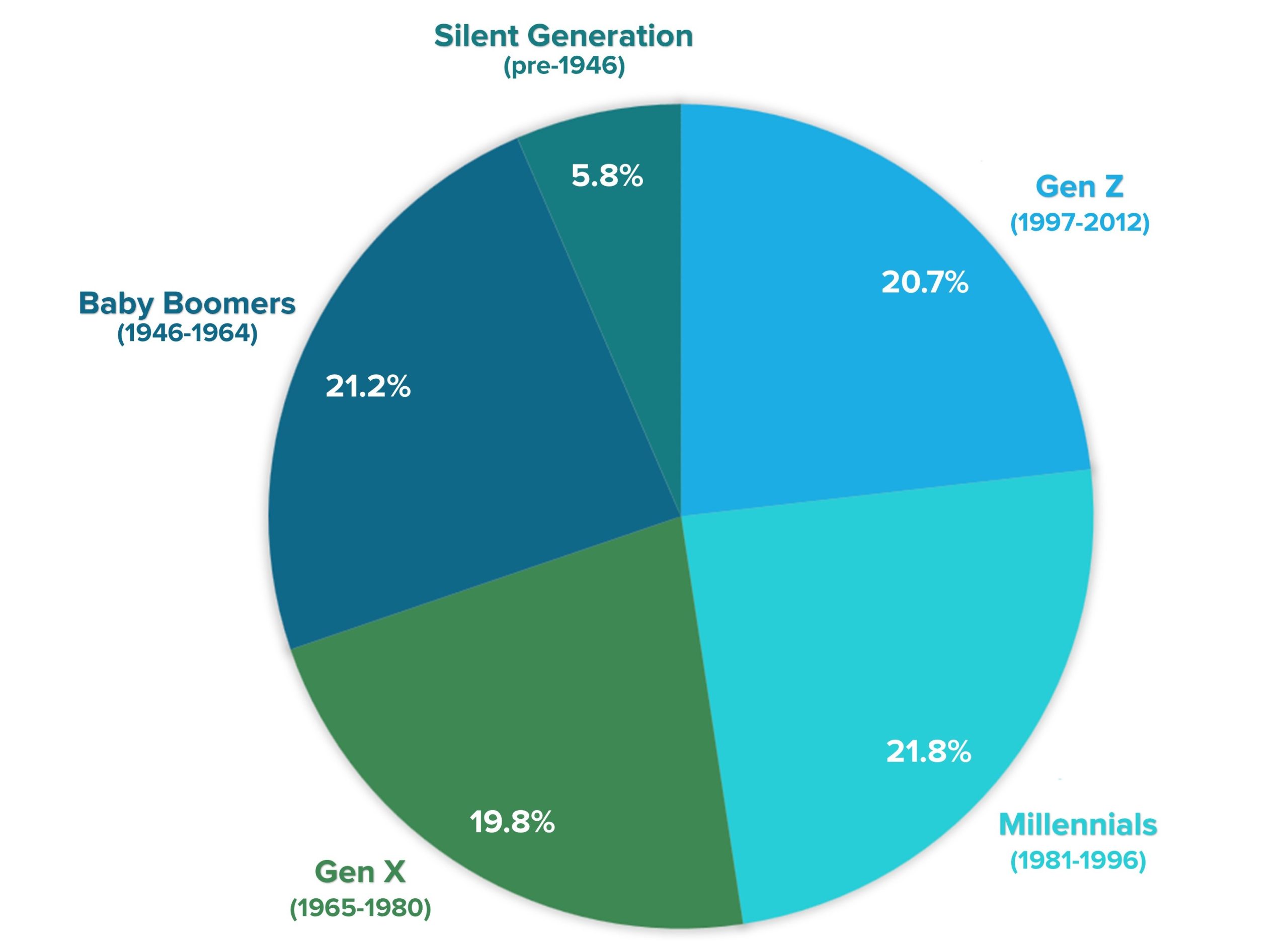

The abundance of equity that was gained over the last five years and certainly over the last decade has many sellers making great gains. Median price in King County, including single-family residential homes and condos, is up 31% since 2020 and up 73% since 2016; and in Snohomish County, it’s up 40% since 2020 and up 99% since 2016. Bear in mind, real estate is a long-term hold investment, and timing a sale after the original purchase can have an impact. We are seeing many Baby Boomer sellers start to make big moves towards retirement, enjoying their well-earned financial freedom and, in some cases, addressing health needs. The move-up buyer/seller is returning to the market as well, putting their equity to work for them to purchase a home that better fits their household size and preferred location.

With interest rates predicted to only slowly recede, some buyers are using negotiated credits to buy down their interest rate and decrease their monthly payments. Buyers who are finding a way to make the monthly payments work, either through buy-downs or budgeting, are getting themselves into homes that feel better for their lives. They are also setting themselves up for long-term gains as their nest egg grows while they enjoy their home. It is important for everyone to understand that real estate is not typically a quick come-up investment. The pandemic years skewed that perspective, and returning to more historical norms should be welcomed, as that growth was unsustainable.

If you have been considering a move or know someone who is, now is a great time to consider your options and start planning. We have even seen first-time home buyers eager to jump into the market and start building wealth. I could easily apply the statistics above to your specific location, and we can apply the market conditions to your goals. Meeting up in person or via Zoom to discuss what this market has to offer and answer your questions is the foundation of my service. It never hurts to dream, plan, and discuss whether your desired outcome results in doing something sooner or later. This consultation meeting will lead to confident decision-making based on clarity and trust. It is a positive and proactive step forward, and is always based on the pace of my clients’ wants and needs. It is my goal to help educate in order to empower strong decisions. Please reach out if you want to chat about how your goals align with today’s market or if you know someone who could use this counsel.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link